October 2021 Market Commentary and Performance

October 2021 Market Commentary and Performance

October proved to be a massive month for the cryptocurrency and digital asset markets.

Market Overview:

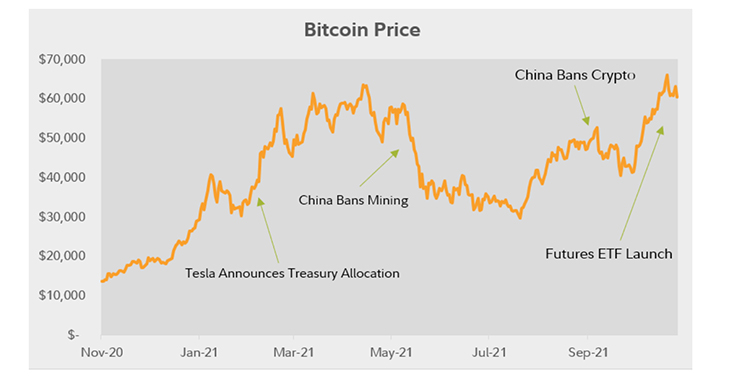

October proved to be a massive month for the cryptocurrency and digital asset markets. After a weak September, Bitcoin (BTC) jumped 10% on the 1st of October, sparked by Federal Reserve Chairman Jerome Powell testifying before Congress that he had “no intention to ban cryptocurrencies, including stablecoins”.

BTC returned 39.9% while the broader market represented by the CCI30 Index gained 29.9%. We expected the outperformance of the CCI30 Index vs BTC over the past few months to revert and Layer 1 protocols to catch up their relative underperformance.

This rally was fuelled further by speculation that a BTC futures ETF would be approved, which was confirmed on the 19th of October, sending BTC to a new all-time intra-day high of $67,000. The first BTC futures ETF by ProShares with its listing on the NY Stock Exchange attracted over $1bn in inflows in the first two days! This was one of the most successful ETF launches in history and another step in for BTC to become a mainstream investment. More importantly, this now opens the door for many more BTC and other cryptocurrency and digital asset ETF’s, and further cements our thesis of increased institutional participation in the space.

A real concern for professional investors who are managing funds across multiple-asset classes and liquidity timelines is how will risk assets be impacted by the current inflationary pressures? We are seeing inflation building across both energy, soft and hard commodities, and wages. The main concern is whether this is a structural shift or just seasonal due to the lower base of 2020.

=Currently there is $28.5 trillion of US federal debt outstanding versus US GDP of $22.7 trillion. We expect bond yields to rise meaningfully to accommodate higher expected inflation and funding rates will become stressed, as will consumers and by default banks. This does not bode well for consumers or providers of credit!