September Newsletter and Quarterly Update 2021

September Newsletter and Quarterly Update 2021

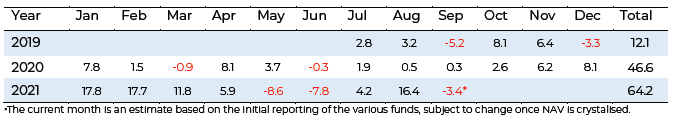

September 2021 Performance

September -3.4%*

YTD 64.2%

12 Months 98.1%

To view this newsletter in PDF, click here

Q3 Commentary

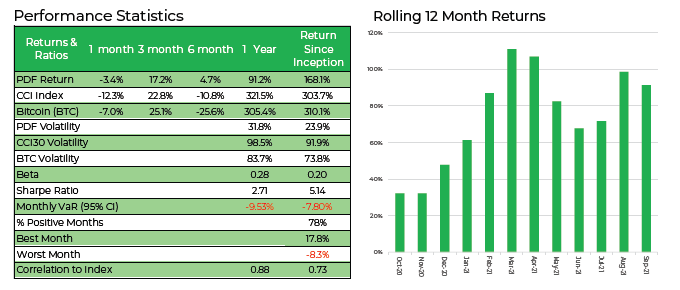

The Portal Digital Fund was down -3.4% for the month of September, historically the cryptocurrency markets toughest month, versus Bitcoin (BTC) down -7% and the CCI30 Index down -12.3%.

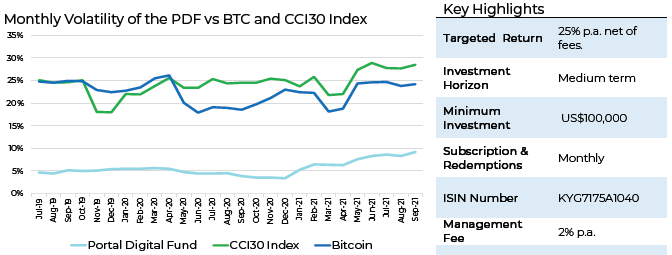

The PDF returned 17.2% net of fees for Q3 versus BTC and the CCI30 Index returning 25.1% and 22.8% respectively, with a third of the volatility. More notably, over the past 6 months the PDF has delivered a positive return of +4.7% versus BTC and the CCI30 Index down -10.8% and -25.6% respectively over the same period.

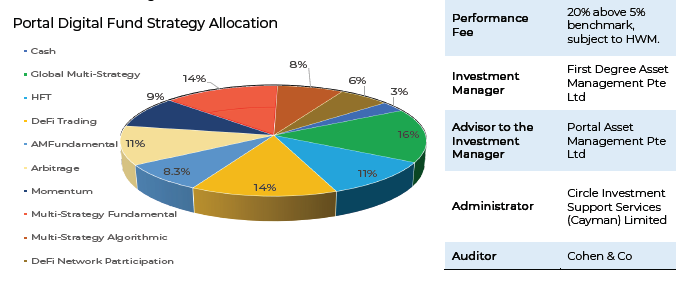

We remain well positioned with investments balanced across both the lower and medium volatility trading funds and higher volatility thematic, fundamental funds. We are pleased to have added two new funds to the PDF that are expected to participate in the next generation of tokens that are coming to market. Both of these funds are high volatility and more fundamental, focused on very niche, differentiated sectors in the DeFi and Smart Contract space and as such we have elected to enter with smaller positions.

Q4 Outlook

Q4 has started off strong with the market up 28% in the first week of October. We remain highly optimistic on the digital asset market given the limited price impact on the cryptocurrency market witnessed upon China’s most recent ban, which suggests significant strength and momentum in the market. There has also been a dislocation between BTC and the wider DeFi / Smart Contract space as investors across various liquidity spectrums and timelines participate vs mostly speculators and traders in BTC and onchain data shows Bitcoin has found a floor at its current price range with a bullish supply shock likely.

In addition, at the start of October, Brazil’s Federal Deputy Aureo Ribeiro has revealed that Brazilians could soon be able to buy houses, cars and even McDonald’s with Bitcoin as it is set to become legal payment in Brazil. South America is fast becoming the new beacon of democracy and innovation!

An extremely worrying development is the inevitable collapse of Chinese property developer Evergrande as it will default on its US$300bn worth of debts. They are just the canary in the coalmine. This week another two developers, Fantasia and Sini Holdings, also defaulted on interest payments. I expect this will lead to homebuyers and banks pulling back which will result in more developers facing liquidity crunches, and I expect this contagion will create a large ripple in their junk bond market as Chinese property developers are one of the largest issuers of high yield credit. This could be a trillion dollar debt default across Chinese real estate developers.

We don’t think this will be China’s Lehman’s moment, but will result in a rapid slowdown in further development and reduce demand for iron ore and steel. China’s government won’t let Evergrande collapse after witnessing the Lehman debacle, but rather will intervene to stabilise the market, in the same way the USA did in 1998 when Long-Term Capital Management’s 100X leveraged Credit hedge fund collapsed. I’m sure that will deal with the “moral hazard” issue differently by severely punishing those responsible instead of rewarding them with bonuses and government roles. It may still take a while for China to get on top of this property bubble, as deflating it too rapidly will result in a similar collapse in their banking system as we have already lived through during the GFC in 2008. Communism certainly hasn’t slowed them down yet.

Finally, the recently released Bank Of America report into the digital asset market (“Digital Assets: Only the first inning -Primer Miner”) has received a lot of positive media and market coverage. They are very bullish on the space as per their opening summary:

“With a $2tn+ market value and 200mn+ users, the digital asset universe is too large to ignore. We believe crypto-based digital assets could form an entirely new asset class. Bitcoin is important with a market value of ~$900bn, but the digital asset ecosystem is so much more: tokens that act like operating systems, decentralized applications (DApps) without middlemen, stablecoins pegged to fiat currencies, central bank digital currencies (CBDCs) to replace national currencies, and non-fungible tokens (NFTs) enabling connections between creators and fans. Venture Capital digital asset/blockchain investments were $17bn+ in 1H/2021, dwarfing last year’s $5.5bn. This creates a new generation of companies for digital assets trading, offerings and new applications across industries, including finance, supply chain, gaming and social media. And yet we’re still in the early innings. The largest near-term risk we see is regulatory uncertainty.”

Exciting and uncertain times indeed.

Please feel free to contact us should you have any queries.

Description

The Portal Digital Fund (the “Fund”) is an actively managed Global Fund of Hedge Funds focused on the digital currency investment space. The Fund seeks to achieve medium to long-term growth through investing in a diversified portfolio of 8-10 specialist fund managers running uncorrelated digital currency trading strategies. The Fund is focused on absolute returns and expects to generate substantial outperformance with lower volatility versus the CCI 30 Index, the benchmark for digital currencies. The Fund’s targeted returns are 25% p.a. over a rolling 5-year period net of fees

Investment Strategy Performance Statistics and Rolling 12 Months Returns

Fund Characteristics:

- Uncorrelated to global equity, currency and debt markets

- Access to best-in-class global fund managers specialising in digital currency-related strategies

- A rigorous and repeatable due diligence process

- Absolute return investment objective with managed volatility, seeking consistent incremental growth in capital

- A robust risk-management approach, with an unrelenting focus on capital preservation

- High liquidity and low exposure to systematic market risk

- Targeted volatility of 15%-17% p.a. with a targeted return of 25% p.a. net of fees

Investment Strategy

Our core thesis is predicated on our firm belief that ‘everything is about to change’ as digital assets become the fourth superclass of assets. As the digital currency market formalises and becomes regulated, it continues to represent a new frontier for accredited investors to seek superior risk-adjusted returns that are uncorrelated with traditional equity and debt markets. These markets are inefficient and represent substantial sources of alpha for skilled investment managers.

Our experienced team brings an institutional-grade investment approach combining both quantitative and qualitative investment analysis with prudent portfolio construction to provide access to this unchartered space. We aim to consistently deliver positive performance with reduced volatility via uncorrelated strategies that achieve upside as the sector grows and which preserve capital in down-markets via diversification across differing systematic trading strategies.