The Bullish Case for Cryptocurrencies Webinar Recording and Notes

Webinar Notes

Introduction

Guest Speaker Michael Casey

Chief Content Officer; CoinDesk; Cofounder and Chairman, Streambed Media; author of five acclaimed books, speaker, educator/researcher. The economics of blockchain and digital innovation

In an almost three-decade media and academic career in which I lived and worked on five different continents, my interests have coalesced around the social, economic and political impact of digital technology and globalization. Most of that time I’ve been a journnalist, including 18 years at Dow Jones and The Wall Street Journal. I’ve since added other descriptors to my resume: author, researcher, teacher, mentor, communicator, advisor and entrepreneur, and now media executive. I focus on projects that harness blockchains and other technologies to improve access to the digital economy and I seek to advance public understanding of the potential for digital innovation to further public good.

I am currently Chief Content Officer at CoinDesk, Inc., the leading news and information provider for the blockchain and digital assets industry. My team of journalists, multimedia professionals, research analysts and event programmers are driving the global conversation around the transformation of finance and economics.

In am also the founder and chairman of media analytics company called Streambed Media, which uses breakthrough cryptographic and blockchain technologies to add rich data to videos and other digital content.

Meanwhile, at MIT, I remain a pro bono advisor to MIT Media Labs’s Digital Currency Initiative. As a public speaker, I provide presentations, lectures and consulting services to help audiences and corporate leaders learn about blockchain technology and to face the impact of digital disruption. (Speaking agent: http://www.thelavinagency.com.)

Finally, I’m the author of five books covering topics of digital culture , economics and globalization.

Market Commentary

- After a volatile and tough quarter 2, cryptocurrencies are on the rise again with BTC rallying 62% form $28,000 on the 20th July 2021 breaking through previous resistance from the high in January 2021 at $42,000 which now becomes support. We expect $50,000 is next real resistance.

There have been both positive and negative headlines over the past few weeks:

This comes in the middle of a global scepticism about the regulatory ambiguity of cryptocurrencies

The largest cryptocurrency exchange in the U.S. warned, however, that its number of monthly transacting users and trading volume would be lower in the third quarter. The U.S.’ largest cryptocurrency exchange grew to 8.8 million monthly transacting users (MTUs) and 68 million total users in the quarte

“This is in part due to the growth of DeFi applications on other Ethereum Virtual Machine compatible networks that users can access via MetaMask, like BSC and Polygon.”

Another CyberPunk NFT up for sale for $90.5 million

The work is in the form of an NFT – meaning it is authenticated by blockchain, which certifies its originality and ownership.

The latest congressional infrastructure bill, which includes provisions on the regulation of crypto assets, could help legitimize cryptocurrencies within the mainstream financial community,

- We are in agreement with Michael who believes that this is a very positive development over the longer term.

- This gives credibility to cryptocurrency as an asset class and legitimises institutional investing in the space.

- Going forward the inclusion of cryptocurrency in such a substantial piece of legislation will begin the process of formalising the regulatory environment.

- Nathaniel Whittemore of Coindesk notes:

- “The infrastructure bill saga represents the first act in crypto entering the highest echelons of political discussion in the U.S. Instead of pushing quiet legislation through, this crypto provision gave the industry an unprecedented platform and relevance in the eyes of lawmakers. Will crypto be a key issue for lawmakers in the future?”

- “Still, the bigger deal by far is the loudness of the crypto community. 40,000 calls, an entire industry watching C-SPAN on the weekend. This isn’t normal. This is what happens when you get a group of people who have utter conviction that they are part of a generationally significant shift involved.”

- “I couldn’t find the exact tweet but someone said I don’t think we’ll see a politician again without a crypto strategy.”[1]

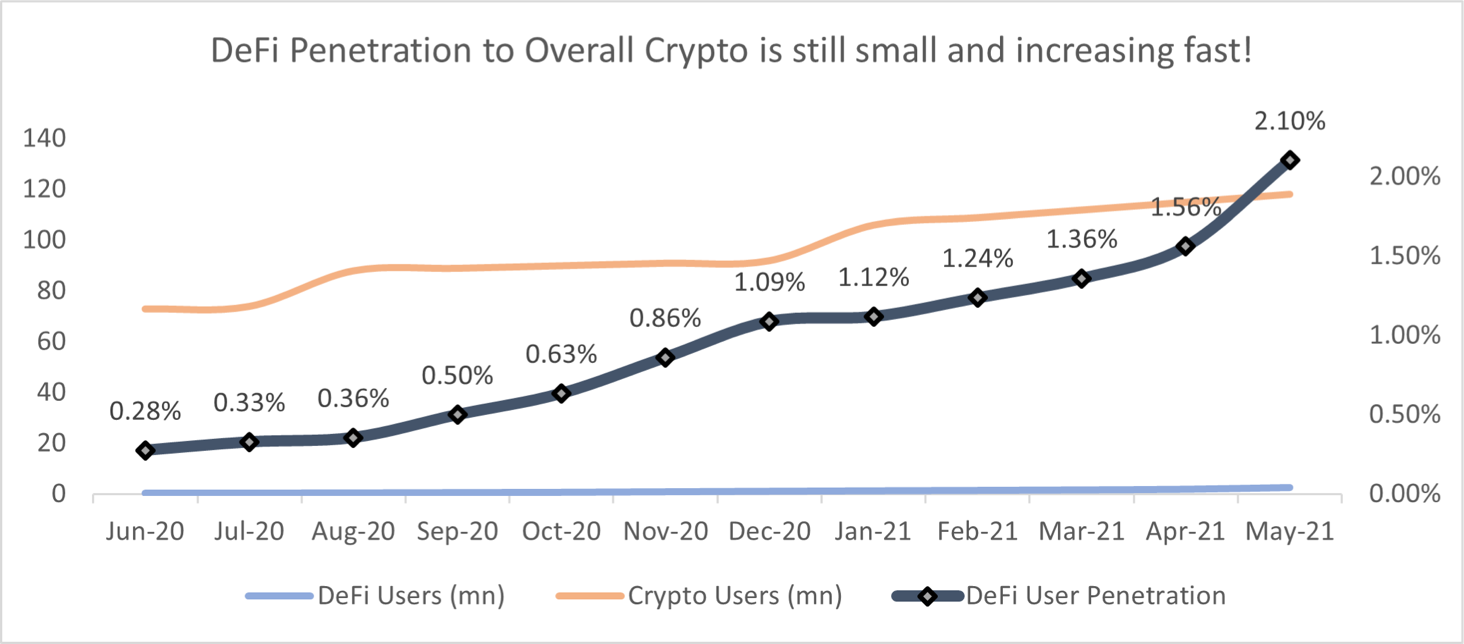

The real story is not about Bitcoin, the story in our opinion is DeFi:

Ethereum has unleashed a wave of financial innovation.

We remain firmly convinced of the long term bullish developments that have taken place, between the Chinese clampdown on miners and the new attempts to define and legislate cryptocurrency’s as an asset class, will continue to underpin the positive momentum in this nascent and emerging market.

—

[1] https://www.coindesk.com/podcasts/the-breakdown-with-nlw/infrastructure-bill-provision-tanked-shelby