August 2021 Newsletter

August 2021 Newsletter

August 2021 Performance

August 16.1%*

YTD 67.3%

12 Months 98.1%

Description

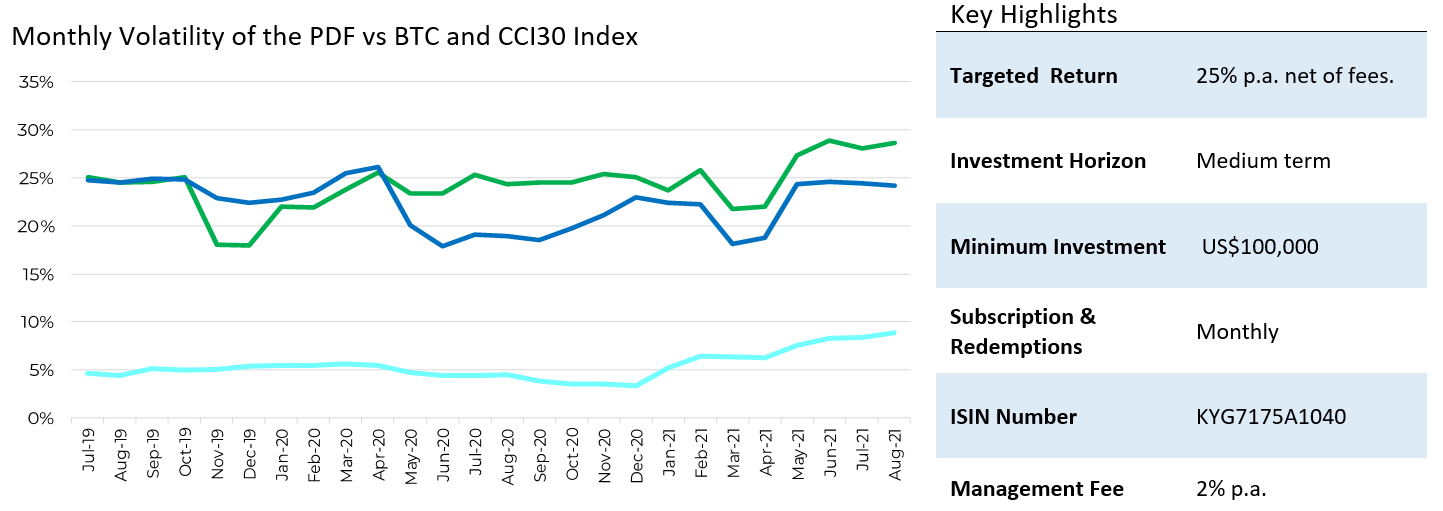

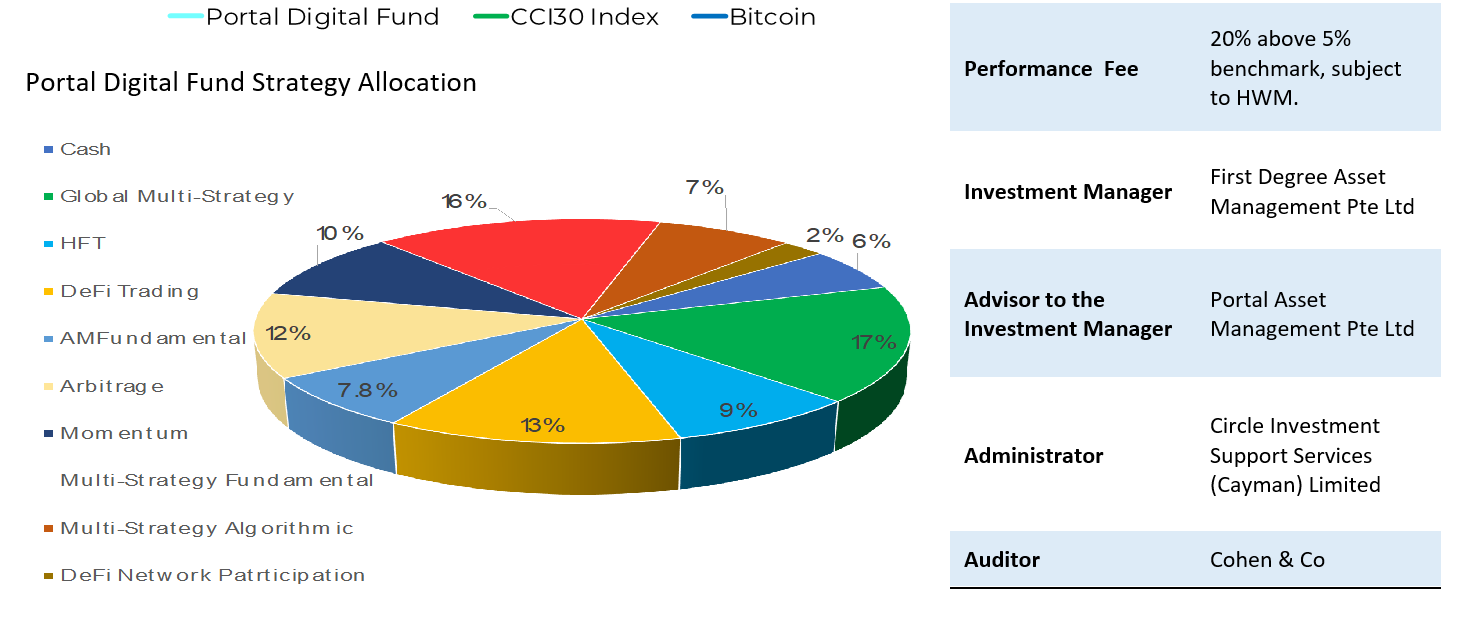

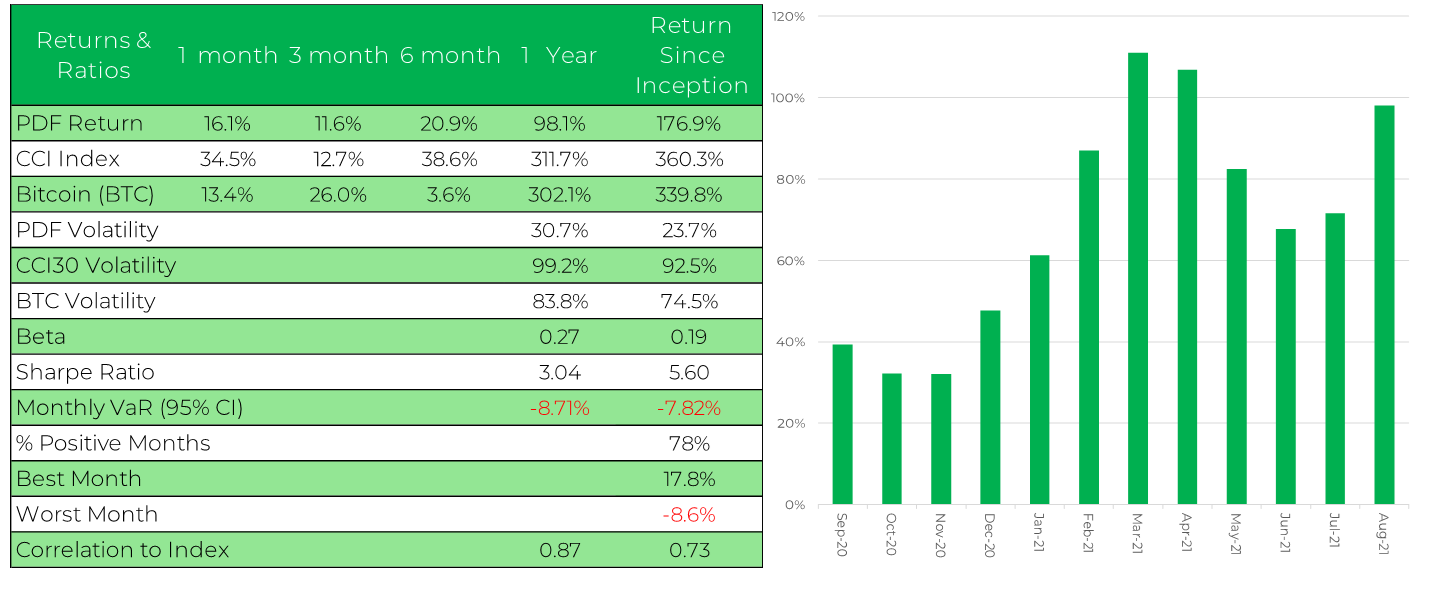

The Portal Digital Fund (the “Fund”) is an actively managed Global Fund of Hedge Funds focused on the digital currency investment space. The Fund seeks to achieve medium to long-term growth through investing in a diversified portfolio of 8-10 specialist fund managers running uncorrelated digital currency trading strategies. The Fund is focused on absolute returns and expects to generate substantial outperformance with lower volatility versus the CCI 30 Index, the benchmark for digital currencies. The Fund’s targeted returns are 25% p.a. over a rolling 5-year period net of fees.

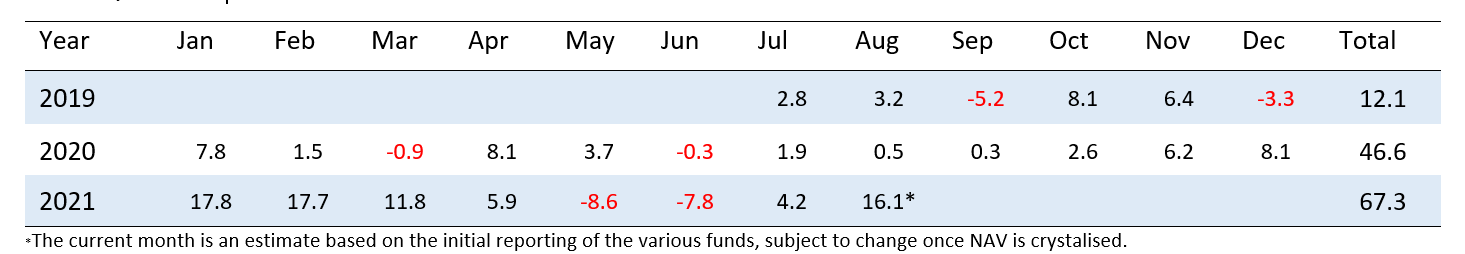

Strategy Monthly Returns

Investment Strategy Performance Statistics and Rolling 12 Months Returns

Fund Characteristics:

- Uncorrelated to global equity, currency and debt markets

- Access to best-in-class global fund managers specialising in digital currency-related strategies

- A rigorous and repeatable due diligence process

- Absolute return investment objective with managed volatility, seeking consistent incremental growth in capital

- A robust risk-management approach, with an unrelenting focus on capital preservation

- High liquidity and low exposure to systematic market risk

- Targeted volatility of 15%-17% p.a. with a targeted return of 25% p.a. net of fees

Investment Strategy

Our core thesis is predicated on our firm belief that ‘everything is about to change’ as digital assets become the fourth superclass of assets. As the digital currency market formalises and becomes regulated, it continues to represent a new frontier for accredited investors to seek superior risk-adjusted returns that are uncorrelated with traditional equity and debt markets. These markets are inefficient and represent substantial sources of alpha for skilled investment managers.

Our experienced team brings an institutional-grade investment approach combining both quantitative and qualitative investment analysis with prudent portfolio construction to provide access to this unchartered space. We aim to consistently deliver positive performance with reduced volatility via uncorrelated strategies that achieve upside as the sector grows and which preserve capital in down-markets via diversification across differing systematic trading strategies.

Disclaimer:This document does not constitute an offer of Participating Shares in the Fund. The offer of Participating Shares is made solely pursuant to the Offering Memorandum for the Fund dated 10 February 2020 (the “Offering Memorandum”), and an application for subscription for Participating Shares may only be made by completing and returning the subscription agreement issued by the Fund (the “Subscription Agreement”). Copies of the Offering Memorandum and the Subscription Agreement may be obtained from First Degree Global Asset Management Pte. Ltd., the Investment Manager of the Fund.

Notice to Investors in Switzerland: This is an advertising document.

The Confidential Offering Memorandum, the Articles of Association as well as the annual reports of the Fund may be obtained free of charge from the Swiss Representative. In respect of the Shares distributed in Switzerland to Qualified Investors, place of performance and jurisdiction is at the registered office of the Representative.

Swiss Representative: FIRST INDEPENDENT FUND SERVICES LTD, Klausstrasse 33, CH-8008 Zurich.

Swiss Paying Agent: NPB Neue Privat Bank Ltd, Limmatquai 1/am Bellevue, P.O. Box, CH-8024 Zurich.