Fund of digital hedge funds, managed to institutional standards.

Radiance Multi-Strategy Hedge Fund focused on fundamental investing in the digital asset and cryptocurrency space globally.

The Portal Digital Fund is an Institutional Grade, Multi-Strategy, Digital Currency Fund.

The fund targets to deliver investors:

Since inception in the fund has returned

Crypto Fund Managers

The Portal Digital Fund is an actively managed Global Fund of Hedge Funds focused on the digital currency investment space.

The Fund seeks to achieve medium to long-term growth through investing in a diversified portfolio of 8-10 specialist fund managers running uncorrelated digital currency trading strategies. The Fund is focused on absolute returns and expects to generate substantial outperformance with lower volatility versus the CCI 30 Index, the benchmark for digital currencies. The Fund’s targeted returns are 25%-30% p.a. over a rolling 5-year period net of fees.

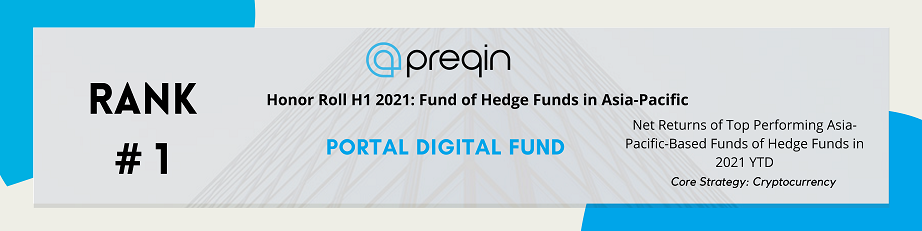

The Fund was ranked 1st by the Preqin fund data source as the top performing Fund of Hedge Funds within the Asia-Pacific Fund of Hedge Fund category in its H1 2021 Honour Roll with 67.3% net of fees and has been ranked 3rd in the global Multi-Advisor section of the BarclayHedge Alternative Investment Rankings for 2020 on the performance of 46.6% for the 2020 calendar year.

The Portal Digital Fund is based in the Cayman Islands and is managed by Singapore based First Degree Global Asset Management. Portal Asset Management Pte Ltd is the adviser to First Degree Global Asset Management Pte Ltd.

Why investors choose Portal?

Our Mission

Portal seeks to provide investors with simple to invest, institutional-grade funds that give broad exposure to the emerging digital asset class.

BarclayHedge

Ranked third in the global Multi-Advisor section of the BarclayHedge Alternative Investment Rankings for 2020

Preqin

Ranked by Preqin as the #1 Fund of Hedge Funds in Asia Pacific in H1 2021, and has been operating since early 2020.

Don’t understand the difference between Bitcoin and Blockchain?

Find out more about how the digital asset markets work, what a blockchain is, where digital currencies are going and what are the drivers. Browse a selection of webinars, papers, and news stories about our company and digital asset markets.

Radiance Multi-Strategy Fund launched in July 2022

The Fund is designed to provide investors with a highly curated diversification of what the manager considers best in class tokens from within all major sections of blockchain including Layer 1, Layer 2, Interoperability, NFT’s, Defi, Play2Earn and Gaming. In addition some 30% of the fund will have exposure to early stage tokens in emerging classes. All of this whist providing investors with a 30-day redemption option.

We seek Venture Capital returns without the multi-year lock up that goes with VC investing.

Press and Media

March 2024 Fund Performance

MARCH: +8.7% CCI 30: +27.1% 2023: +49.3% SINCE INCEPTION: +238.5% MARCH: +25.52% CCI 30: +27.1% 2023: +76.49% SINCE INCEPTION: +76.17%

MARKET UPDATE: March Commentary

Welcome to this month’s edition of Portal Asset Management’s Market Commentary. In this two-part series, we present a dual analysis covering the broader economic spectrum and a focused evaluation of the digital token arena. Initiating the discourse, Mark Witten, our CIO, offers a Macro Economic overview, articulating the forces and trends influencing the financial world. […]

February 2024 Market Performance

February: +20*%CCI 30: +34.8%2023: +49.3%Since Inception: +217% February: 29%*CC130: +34.8%2023: +78.1%Since Inception: +47.7%March MTD 32.5% BarclayHedge ranksPortal Asset Management# 1 Multi-Advisorfor Net Returns 2023 Key Highlights – The Insto’s Have Landed– $11.7 billion invested to date across all BTC ETFs. – 600 million daily inflows to BTC ETFs.– The Portal Digital Fund was up 20% in February, […]

Portal Asset Management have been featured in: