September 2020 Newsletter

September 2020 Newsletter

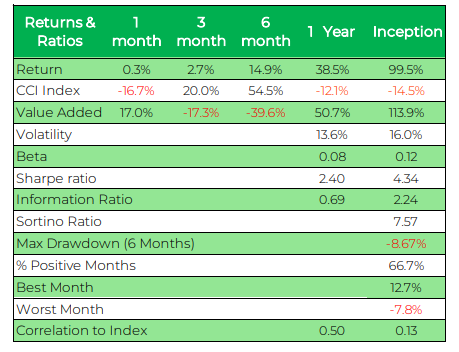

The Portal Digital Fund finished the month up 0.3% versus the CCI30 Index which was down -16.7% and Bitcoin down -8.1%. YTD Portal up 24.5%.

This is an excellent result given that Volatility has remained subdued and range bound between 30%-40% as investors and traders have been focused on the DeFi space, which has attracted enormous liquidity.

To put it into context, the month started off with Bitcoin falling $2,000 in the first two days of the month from a high of $12, 037 to a low of $10,011. It traded mostly sideways with some sharp rallies and quick reversals for the remainder of the month and only in October has it broken up through $11,500. This has made it quite a difficult environment for funds to navigate as no clear signals or trends emerged.

We do expect the volatility to increase as we get closer to the highly contested US elections on November 3rd, a second hard lockdown starting in London and some parts of the USA, and previously classified documentation relating to the Russian probe and Benghazi debacle are disseminated.

An assessment of our underlying funds:

- Global Systematic Crypto Fund: Up 3.2% net, positioned long volatility for October.

- High Frequency Trading Fund: Up 2.1% net, neutral volatility, positioned for an increase in volumes and spreads.

- Momentum (Technical) Fund: Up 6.5% net, waiting for clear signals to execute and an increase in volatility.

- Arbitrage Fund: Up 0.6%, no change in positioning and strategy.

- Momentum (Token) Fund: Down -6.8%, due to the market having no clear trends and was largely rangebound. Both BTC and ETH were consolidating. As above, there was one big move in the beginning of September, however, it reversed quickly, resulting in a loss. The drawdown level is within our expectation. Our expected performance is 50% annualized return with a 20% max drawdown.

- Multi-Strategy Quantitative Fund: Down -4.6%. The fund has had an excellent run recently and has taken some risk off the table, particularly in the DeFi space.

Conclusion

Going forward we have allocated additional funds to one of the higher volatility funds in our stable and we plan to increase our volatility and subsequent expected return based on our improved Sharpe ratio. We are positioned for an increase in both volume and volatility and are reviewing additional funds with an expectation of further interest in the DeFi space.

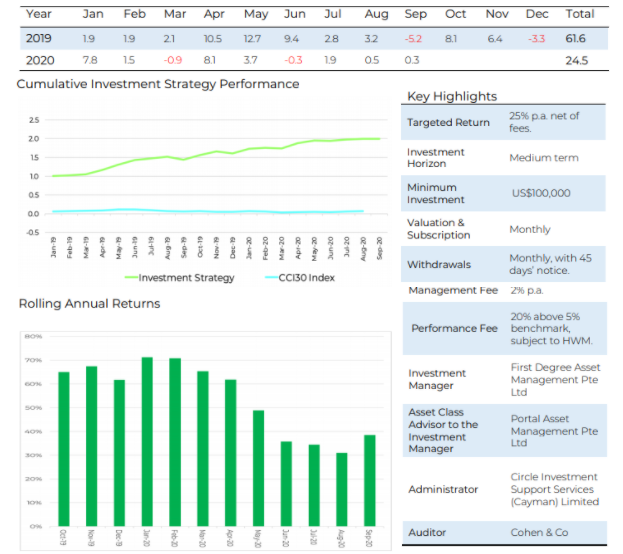

Description

The Portal Digital Fund (the “Fund”) is an actively managed Global Multi-Manager Fund focused on the digital currency investment space. The Fund seeks to achieve medium to long-term growth through investing in a diversified portfolio of 5-10 specialist fund managers running uncorrelated digital currency trading strategies.

The Fund is focused on absolute returns and expects to generate substantial outperformance with lower volatility versus the CCI 30 Index, the benchmark for digital currencies. The Fund’s targeted returns are 25% p.a. over a rolling 5-year period net of fees.

Strategy Monthly Returns

Investment Strategy Performance Statistics