Quarterly Update Digital Assets Market Commentary

Quarterly Update Digital Assets Market Commentary

INTRODUCTION

As the saying goes: “A rising tide lifts all boats”. In this case it seems the tsunami of excess liquidity is pushing asset valuations globally as the Great Reflation injects unlimited QE and the search for yield continues. This is great for asset holders, but bad for inflationary expectations and main street. With oil close to it previous pre-Covid levels, it seems the markets expect the reopening of the economy will occur faster than expected.

MARKET VALUATIONS

We must remember that equity markets are forward predictors as well as discounting machines. They represent one of the best leading indicators for economic activity and expected company earnings. The S&P 500 has continued to make new all-time highs. However, underneath the surface, there has been a noticeable shift in leadership as the Russell 2000 small cap index has underperformed the S&P 500 by 10% since peaking on March 12. Furthermore, some of the cyclical parts of the equity market are starting to underperform, while defensives are doing better. Why is this?

We believe that the breakdown of small caps and cyclicals is a potential early warning sign that the actual reopening of the economy will be more difficult than initially expected. While policymakers have provided tremendous support for the economy with both monetary accommodation and fiscal stimulus, the lockdowns have reduced supply, destroying it in many cases. As a result, we are now seeing evidence of supply shortages in everything from materials and logistical support to labour. With that comes significant execution risk and potential surprises that aren’t priced, particularly on operating margins as companies ramp up.

GLOBAL ECONOMIC GROWTH

The global economic recovery is accelerating as evidenced by the International Monetary Fund (IMF) upgrading its already bullish global economic outlook last week. The IMF now foresees +6% growth in world GDP this year, a 0.5% upgrade from its January update.The improvement in outlook is largely down to upgrades in expected US growth despite downgrades in expected Chinese growth, where the IMF now predicts a +6.4% rise in US GDP, a major upgrade in its forecast. This implies the US economy will surpass its pre-Covid levels in 2021, a remarkably speedy recovery, driven by the Technology and Retail sector in large part..

INFLATIONARY EXPECTATIONS

Just as important as real GDP forecasts in this recovery is inflation. Recently, rising inflation expectations spooked markets, and rightly so. The US 10 Year Treasury has risen from 0.93% to 1.65% in Q1 2021. Uncontrolled inflation would be a major headwind for any economic recovery and could have dramatic implications for financial markets. Currently, the expectation is for low and stable inflation alongside strong economic growth, which would be very positive for global equity markets.

Jamie Dimon, CEO of JPMorgan Chase, said last week in a commentary to shareholders that he believes “…the US economy could experience sustained economic growth, high savings rates, large fiscal stimulus and supportive monetary policy combining to drive a post-pandemic boom, alongside low and controlled inflation.”

Investors should remain cautiously optimistic. Although the momentum of the global economic recovery is accelerating, and the ‘V-shaped’ recovery so many had hoped for is now the base case assumption, we are not out of the woods yet, particularly with respect to the trajectory of inflation. There are also many unanticipated second order effects from the pandemic, particularly increased state and corporate sponsored surveillance and censorship, that will dampen confidence.

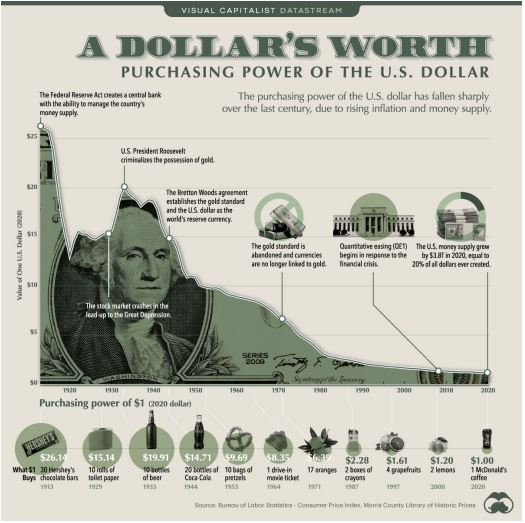

DEBASEMENT OF FIAT CURRENCY CONTINUES

We continue to believe that this will be positive for digital currencies as future QE reduces the purchasing power of fiat currencies. The purchasing power of a currency is the amount of goods and services that can be bought with one unit of the currency. For example, as per the graphic below, one U.S. dollar could buy 10 bottles of beer in 1933. Today, it buys you a small McDonald’s coffee.

In other words, the purchasing power of the Dollar has decreased over time as price levels have risen. This is basically because there are significantly more Dollars in the system. Money supply (M2) in the U.S. has skyrocketed over the last two decades, up from $4.6 trillion in 2000 to $19.5 trillion in 2021, a 350% increase in liquidity!

The effects of the rise in money supply were amplified by the financial crisis of 2008 and more recently by the COVID-19 pandemic. In fact, around 20% of all U.S. dollars in the money supply, $3.4 trillion, were created in 2020 alone.

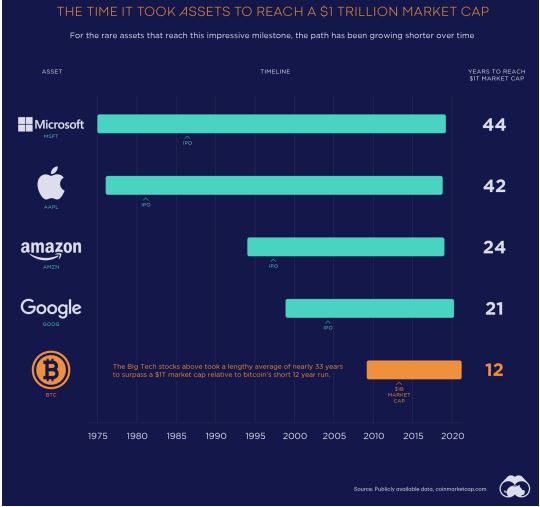

BITCOIN MARKET CAP BREAKS $1 TRILLION

Bitcoin (BTC) has seen much-increased interest and acceptance in markets. At the start of 2021, the cryptocurrency had a more modest market cap of $500 billion, but has gained more than another $500 billion since. As discussed in our last quarterly update in December, the onslaught of headlines has contributed to extremely bullish investor sentiment, including:

• Corporate Interest: Elon Musk and Michael Saylor have made sizable

investments in BTC through Tesla and MicroStrategy, respectively. It’s estimated the gain from Tesla’s $1.5 billion bitcoin investment was greater than the profits from the entirety of their business in 2020.

• New ETFs: Multiple BTC ETFs focused were recently approved by Canadian regulators and some have already launched on the Toronto Stock Exchange (TSX). For many years, the Grayscale Bitcoin Trust was the only readily accessible investment vehicle trading on equity markets that had exposure to BTC.

• Financial institutions joining in: Mastercard, Visa, Paypal, Morgan Stanley and Bank of New York Mellon have made announcements to make it easier for customers to use cryptocurrencies and provide custody for HF’s.

(The article below on NFT’s has been contributed by Nitin Gaur, a Director of IBM’s WW Financial Services and Digital Assets and a member of our Investment Committee.)

Explosive Growth in Asset Tokenization and NFTs Is Fueling Web 3.0 Growth and Testing DeFi Resolve

Introduction – NFT, DeFi, and Web 3.0 Intertwined

While blockchain itself provides the technology constructs to facilitate exchange, ownership, and trust in the network, it is in the digitization of value elements where asset tokenization is essential. Tokenization is the process of converting the assets and rights or claims to an asset into a digital representation, or token, onto a blockchain network.

This distinction between cryptocurrency and tokenized assets is important to understanding the exchange vehicles, valuation models, and fungibility across various value networks that are emerging and posing challenges around interoperability. These are not just technical challenges, but also business challenges around equitable swaps. Tokenization of assets can lead to the creation of a business model that fuels fractional ownership or the ability to own an instance of a large asset. While discussing asset tokenization in a previous article, I also discussed the value of an instance economy in democratizing finance, commerce, and global access, as well as creating a broader global marketplace at a scale never seen before.

With digital assets and their fungibility in a blockchain ecosystem, there are various drivers of valuation. These include tokens based on crypto-economic models that are driven by supply and demand and the utility of the network; non-fungible tokens (NFTs) that have an intrinsic value, such as identity, diplomas, and healthcare records—essentially tokens that are simple proof-validations of the existence, authenticity, and ownership of digital assets; and fungible tokens that are valued on various bases, such as the sum total of economic activity in the network (cryptocurrency), its utility (smart contracts and transaction network processing), assigned values (as in stable coins and security tokens), and so on.

In this article, I address the complex issue of a hyperbolic and rapid rise of NFTs, after a similar meteoric phased rise of decentralized finance (DeFi), creating amazing innovations with immense promise of democratization, new business models, and global marketplaces with global access—all fueled by the basic premise of decentralization and fundamental constructs of tokenization and wallets. While NFTs may be characterized as unique one-of-a-kind cryptographic tokens with some intrinsic value to the holder (ID, health record) or a market (art, collectible). The NFT movement is indicative of a larger token revolution that will not only fuel massive innovation and growth in Web 3.0 protocols but also test the resolve of the DeFi movement and its ability to intersect and provide platforms and an exchange vehicle for all token types.

Growth in Web 3.0 Protocols

The first two generations of web protocols were largely about information dissemination and connecting people, fueled massive growth in information and collaboration, and did wonders for connecting the world. However, those web protocols were never designed to move things of value. Also, as the Web 2.0 era has reached its fullest potential, vulnerabilities, such as fake news and the “bathed-relay” of the movement of assets via a series of intermediaries, have emerged, and threats to the commerce and finance infrastructure risk destabilizing the system. Web 3.0 promises to safeguard all things we value—information, truth, and digital assets, both fungible and non-fungible. Whereas Web 2.0 was driven by the advent of social, mobile, and cloud, Web 3.0 is built largely on three new layers of technological innovation: edge computing, decentralized data networks, and artificial intelligence.

The growth of NFT has not only empowered the ability for artists, skilled professionals, and entrepreneurs to encapsulate innovation in a tokenized form, but also has fueled the democratization of the platform as one of the promises of blockchain technology. The underlying infrastructure includes decentralized storage technologies, efficient consensus protocols, off-chain computing, and Oracle networks to provide connectivity and validation to existing systems. Collectively, the Web 3.0 set of technologies envision a connected, trustless, and accountable network for efficiently delivering value, rather things that we value, thus crafting the infrastructure for things of value. NFTs represent both transferable entities and non-transferable tokens that we value. The latter include things such as our identity, healthcare records, passports, and the like, which represent us and allow us to participate in the digital economy with our own unique digital identities.

As we dare to envision a world with decentralized control and governance based on distributed technology that challenges every business model and governance structure built upon centralized business structures, we do have to ponder not just the shift but the motivation, incentive, and monetization elements that will fuel and power the economic infrastructure to move things of value and thereby keep up with our changing perception (and subsequent realization) of value.

Intersecting with Finance – DeFi

DeFi is the movement in the blockchain applications space that leverages decentralized network technology to disrupt and force a transformation of old financial products into trustless and transparent protocols that facilitate digital value creation and dissemination with fewer or no intermediaries. It is widely understood and accepted that blockchain technology lays the foundation for a trusted digital transactional network that, as a disintermediated platform, fuels the growth of marketplaces and secondary markets due to new synergies and co-creation via new digital interactions and value-exchange mechanisms. While blockchain itself provides the technology constructs to facilitate exchange, ownership, and trust in the network, it is in the digitization of value elements where asset tokenization is essential.

While DeFi aims to deliver the promise of democratization of finance, making it accessible to all, NFTs test the resolve of DeFi in providing a competing yet inclusive asset class and an avenue to provide a medium of exchange, fungibility by other fungible asset classes, and liquidity to a traditionally illiquid market. Asset classes resulting from DeFi protocols and NFTs avail themselves of the advantages of fractional ownership of the assets, blurring the lines between asset classes and using constructs like digital wallets as a receptible of all asset classes. All this is supported by underlying layers of Web 3.0 that provide security and availability via decentralization and trust and immutability via consensus, and they extend these principles to basic compute infrastructure such as storage and interconnect.

Essentially, the commercialization of Web 3.0 protocols that manifest as fungible utility tokens further blurs the lines with diverse financial innovation products (base assets and derivatives) introduced by DeFi, which are also tokenized. So, while decentralization is the underlying theme—and wallet and token are fundamental constructs—these blurring lines are quite profound.

Perspective

NFTs that have an intrinsic value, such as identity, diplomas, and healthcare records, are essentially tokens that are simple proof-validations of the existence, authenticity, and ownership of digital assets. Fungible tokens are valued on various bases, such as the sum total of economic activity in the network (cryptocurrency), utility (smart contracts and transaction network processing), assigned values (as in stable coins and security tokens), and so on. NFTs represent both transferable entities and non-transferable tokens that we value. The latter include things such as our identity, healthcare records, passports, and the like, which represent us and allow us to participate in the digital economy with our own unique digital identities.

The NFT movement is indicative of a larger token revolution that will not only fuel massive innovation and growth in Web 3.0 protocols but also test the resolve of the DeFi movement and its ability to intersect and provide platforms and an exchange vehicle for all token types. Collectively, the Web 3.0 set of technologies envisions a connected, trustless, and accountable network for efficiently delivering value, rather things that we value, thus crafting the infrastructure for things of value.

CONCLUSION

We believe that the global economy is anticipating a much smoother reopening and growth scenario than is realistically feasible. The excessive quantitative easing has resulted in asset price inflation which will feed into second round inflation in food, fuel, goods and services, especially off such a low base as Q2 2020. We additionally believe that digital currencies provide a real solution to the current money-printing crisis and furthermore the Portal Digital Fund provides a real uncorrelated risk-adjusted return in a world of low growth and normalising inflation. Watch for tail-risk; if the liquidity is withdrawn, the system will see a massive reversion to mean and a snap back in asset prices.

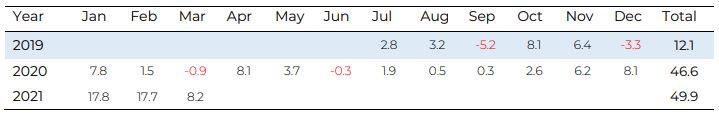

PDF Monthly Returns

Fund Characteristics:

- Uncorrelated to global equity, currency and debt markets.

- Access to best-of-breed global fund managers specialising in digital currency-related strategies

- A rigorous and repeatable due diligence process.

- Absolute return investment objective with managed volatility, seeking consistent incremental growth in capital.

- A robust risk-management approach, with an unrelenting focus on capital preservation.

- High liquidity and low exposure to systematic market risk.

- Targeted volatility of 15%-17% p.a. with a targeted return of 25% p.a. net of fees.

Investment Strategy

Our core thesis is predicated on our firm belief that ‘everything is about to change’ as digital assets become the fourth superclass of assets. As the digital currency market formalises and becomes regulated, it continues to represent a new frontier for accredited investors to seek superior risk-adjusted returns that are uncorrelated with traditional equity and debt markets.These markets are inefficient and represent substantial sources of alpha for skilled investment managers.

Our experienced team brings an institutional-grade investment approach combining both quantitative and qualitative investment analysis with prudent portfolio construction to provide access to this unchartered space. We aim to consistently deliver positive performance with reduced volatility via uncorrelated strategies that achieve upside as the sector grows and which preserve capital in down-markets via diversification across differing systematic trading strategies.

Based on our comprehensive and rigorous due diligence process, we provide investors with access to the best global fund managers specialising in digital currency trading strategies via investment in a diversified Fund providing solid returns irrespective of the direction of the digital currency markets.