Market Update – November 2022

Market Update – November 2022

- FTX collapse is not an industry killer but has caused reputational damage.

- Portal’s DD process has greatly mitigated the impact of market drawdown

- Asset prices are currently at November 2020 levels

- This nascent asset class continues to be volatile

- Portal’s underlying funds are conservatively positioned and sitting on “decent amounts of cash”

- The industry is determined not to let a good crisis go to waste and welcomes regulations

- We continue to believe crypto assets provide the best long-term opportunity of all asset classes.

Market Overview

At Portal Asset Management, part of our investment philosophy is to continuously perform objective and independent analysis to ensure we are seeing things as they are, not worse than they are, and then in seeing things as what they could be, and we believe, will be.

The events in the cryptocurrency and digital asset (“crypto assets”) industry over the last few weeks have been very disappointing. We provided our initial thoughts and analysis on the FTX debacle on the 15th of November, and as we initially suspected FTX was a failure caused by fraud and poor corporate governance, not in any way due to the blockchain and crypto asset technology underlying and powering the industry.

Bad actors exist in all industries, and we have seen real estate, credit and stock scams along with Ponzi schemes in all asset classes, most significantly Bernie Madoff with his $65bn Ponzi scheme in 2008, surpassed only by Enron’s Kenneth Lay and Jeffrey Skilling’s accounting fraud that lost $74bn of shareholder’s capital.[1] We believe that what happened with FTX, although small by comparison, is another unfortunate case of corporate fraud centred on, in this instance, the crypto asset space.

Portal’s Investment Thesis

In times of market stress, it is important to review and confirm our investment thesis. We have spent a lot of time and effort in formulating and improving this since 2019 and it has, and naturally will continue to, evolve as both we and the markets evolve.

The most important aspect of our DD process is how we address and mitigate the operational risks of investing in the crypto asset market, as well as how we navigate these in the future. This has and will continue to be reviewed and updated alongside our underlying fund managers.

We believe even more so now with the attractive valuations of the asset class that crypto assets offer very appealing investment return opportunities akin to those available in early-stage VC technology investing, but with a significant difference: digital assets have liquid secondary markets which trade globally and continuously, 365 days a year, so your capital is not locked-up for 5-7 years.

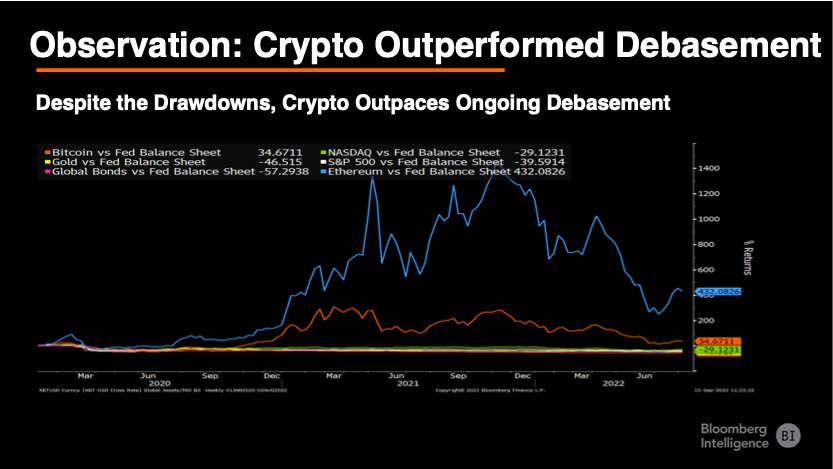

Due to its relatively small size and limited number of institutional participants, this young asset class has greater volatility than traditional markets. We have just ended a decade of very low interest rates and increased liquidity, and this has caused an enthusiastic cycle of exuberance, risk seeking and inevitably now the unwinding of that exuberance and the removal of those who demonstrated recklessness. That being said, crypto assets have outperformed debasement of fiat, gold, equities and bonds over the past 3 years since “unlimited QE” became a reality.

Of course, this is true for many areas in the economy, but it’s more extreme on the up and down in crypto. We believe that we are now finishing the unwinding period, and that the next wave to the upside of the cycle is more likely to begin after such a period of consolidation.

In line with this, our view is that our investment process will continue to deal with this young asset class from an asset selection and volatility management perspective, and our operational diligence will continue to address the reality that counterparty risks are substantial. Both investment and counterparty risks each need to be thoroughly researched, understood, mitigated, and compensated for.

We, along with the underlying funds we invest in, have a comprehensive counterparty due diligence process and always aim to invest in funds that limit their counterparty risk to well-run, low risk, regulated, and well-capitalized organizations such as Coinbase, Kraken, Fidelity, and J.P. Morgan. The majority of the fund managers we follow and invest in are sitting on a decent amount of cash currently to weather the post-FTX fallout and they al expect this to likely be the final wave of contagion.

Digital Asset Week Feedback

We have also received feedback from our fund managers who attended the Digital Asset Week in London. The following key take aways affirm our long-term outlook and confidence in the crypto asset space:

- While everyone was talking about FTX, very few were directly affected. Most people attending had little to no exposure to FTX

- Attendees at conferences are already in the crypto industry and are not leaving, they are continuing to build their businesses, FTX has not change that. FTX while a disaster, it did not kill the industry. The crypto industry as a whole is too big to get wiped out from one failure like FTX, Terra Luna, etc

- FTX was a failure due to fraudulent human behaviour, not of the technology

- The reasons for the SBF / FTX failure are due to fraud, misappropriation of customer assets, over leverage, poor accounting, lack of transparency, lack of oversight and corporate governance, lack of regulation. In a bull market this does not get uncovered. In a bear market and in a bank run, it gets uncovered.

- There is a need for more regulation in the crypto space: especially for financial disclosures, transparency, governance, accounting standards

- There is a need for industry self-regulation like FINRA which the industry can do well before government regulation

- There is a need for greater due diligence to better understand counterparty risk. There is a need for digital exchanges to publish a proof of assets and liabilities on a regular basis and an audited Merkle Tree showing cryptographic proof of all customer accounts and assets.

- On an optimistic note, people see that the FTX crisis will make this young industry stronger. “Don’t let a good crisis go to waste”. We all learn from FTX’s mistakes and implement new practices, new safeguards, new regulations to prevent future blow ups.

- This will slow institutional adoption in the short run but not in the long run. In the short run, many institutions were frozen in crypto winter after Terra Luna, 3 Arrows, Celsius. FTX has put institutions into deep freeze. But better industry practices will emerge from these crises, which will make the crypto industry more institutional in the long run.

- Large Institutions are embracing blockchain technology and see the efficiency benefits. For example, JPM has 275 people in their blockchain group and did a large bond issuance using blockchain technology. UBS and Credit Suisse have similar blockchain projects. FTX is not delaying any of their progress in using blockchain technology in their operations

All participants believe that FTX was not an industry killer, but has caused reputational damage.

Conclusion

We reiterate that we continue to believe that crypto assets provide the best long-term opportunity of all asset classes and will outperform significantly when global macro-economic conditions moderate and confidence in risk assets and this sector is restored.

The FTX debacle is negative for this young asset class as it has caused a substantial short-term loss of confidence, amid fears of contagion risk and general deleveraging and in some instances panic. We do believe that this is specifically a CeFi (centralized finance) problem and does not affect DeFi (decentralized finance) – which should benefit from these events as more people realize the risks associated with centralized entities in the digital asset sector.

The use of cryptocurrencies and crypto smart contracts continue to perform well and the global community using them continues to grow as adoption moves up the technology S-Curve, so it is inevitable that this young asset class will recover. Furthermore, as oversight and regulation are implemented, it will grow as large institutions and sovereign funds secure their stake in what we continue to believe is the future of banking, payment systems and a commerce tech platform. Please feel free to contact me should you have any enquiries.

Mark O. Witten