January 2022 Newsletter and Market Commentary

January 2022 Newsletter and Market Commentary

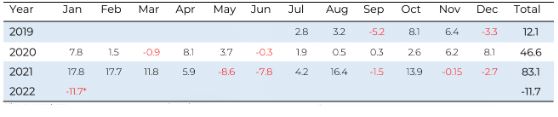

January -11.7%*

YTD 37.2%

12 Months -11.7%

To view this email in PDF, click here.

Market Commentary January continued the risk-off environment that began in mid-November 2021 across all asset classes. As we stated in our “Portal 2022 Outlook” report we believe that “Inflation is being vastly underestimated – rates are going to rise much faster and higher than expected, increasing volatility across all asset classes!”. This played out as expected and the high-growth tech stocks and DeFi assets, in particular, are feeling the brunt of the selloff.

Download full commentary.

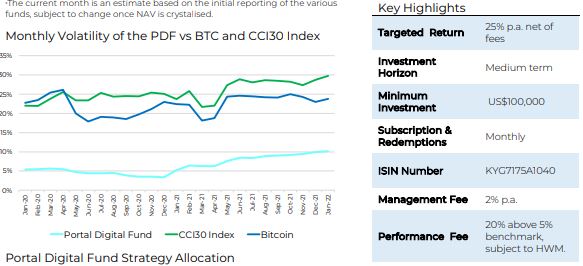

Performance Review The Portal Digital Fund was down -11.7% net of fees in January vs BTC (Bitcoin) down -16.7% and the CCI30 Index down -28.1%. To recap, December was down -2.7% net of fees vs BTC down -18.7% and the CCI30 Index down -15.9%. Over the past three months during the correction that started in November, the Portal Digital Fund was down -14.3% vs BTC down -37% and the CCI30 Index down -42%. This is in line with our targeted mandate.The Portal Digital Fund finished 2021 up +83.1% net of fees vs BTC up +59.5%, with less than a third of the volatility. We are pleased with the robust performance of the Portal Digital Fund in 2021 and continue to be confident with the strength of our investment strategy in 2022.

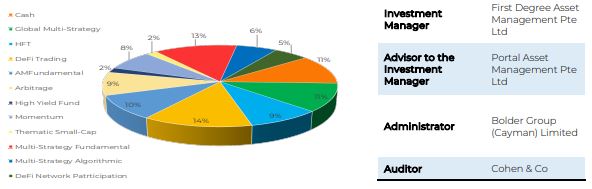

Description

The Portal Digital Fund (the “Fund”) is an actively managed Global Fund of Hedge Funds focused on the digital currency investment space. The Fund seeks to achieve medium to long-term growth through investing in a diversified portfolio of 8-10 specialist fund managers running uncorrelated digital currency trading strategies. The Fund is focused on absolute returns and expects to generate substantial outperformance with lower volatility versus the CCI 30 Index, the benchmark for digital currencies. The Fund’s targeted returns are 25% – 30% p.a. over a rolling 5-year period net of fees.

Fund Characteristics

- Uncorrelated to global equity, currency, and debt markets.

- Access to best-in-class global fund managers specialising in digital currency-related strategies

- Absolute return investment objective with managed volatility, seeking consistent incremental growth in capital via a rigorous and repeatable due diligence process.

- A robust risk-management approach, with an unrelenting focus on capital preservation.

- High liquidity and low exposure to systematic market risk.

- Targeted volatility of 15%-17% p.a. with a targeted return of 25% – 30% p.a. net of fees.

Investment Strategy

Our core thesis is predicated on our firm belief that ‘everything is about to change’ as digital assets become the fourth superclass of assets. As the digital currency market formalises and becomes regulated, it continues to represent a new frontier for accredited investors to seek superior risk adjusted returns that are uncorrelated with traditional equity and debt markets. These markets are

inefficient and represent substantial sources of alpha for skilled investment managers.

Our experienced team brings an institutional-grade investment approach combining both quantitative and qualitative investment analysis with prudent portfolio construction to provide access to this unchartered space. We aim to consistently deliver positive performance with reduced volatility via uncorrelated strategies that achieve upside as the sector grows and which preserve capital in down-markets via diversification across differing systematic trading strategies.

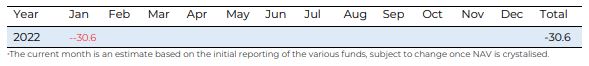

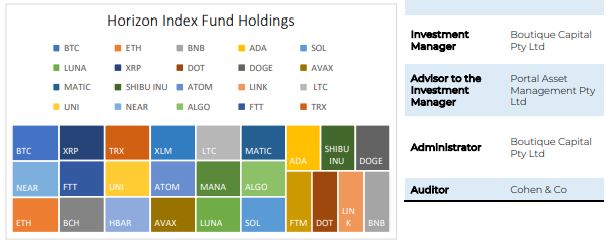

Horizon Index Fund

Performance Review The Horizon weighted index fund was down -30.6% compared with CCI30 index that’s was down -28.1%.

Description

The Fund is a passively managed Equally Weighted Index Fund that is focused on replicating the performance of the top 25 listed digital assets and cryptocurrencies by market capitalisation and is rebalanced monthly. The Fund seeks to replicate the performance of the overall digital asset and cryptocurrency market, and will have volatility in line with the markets.

Fund Characteristics:

- The Fund seeks to replicate the performance of the overall digitalasset and cryptocurrency market and will have volatility in line with the markets.

- The Horizon Index Fund provides access to this emerging digital currency asset class via a passive investment across a broad range of tokens.

Why in Invest in Horizon

The prime benefits of Indexing are:

- Gain broad market exposure by investment in the Horizon Equally Weighted Index Fund

- Australian based, Australian regulated and denominated in Australian Dollars.

- For sophisticated Australian investors, the minimum investment A$50,000.

- Buying and holding a broad market index over the long term reduces volatility and investment costs and can lead to better returns in the long run.

Horizon aims to provide a simple, cost-effective and efficient way to access the broader market, with a 3% management fee and 0% performance fee.

Investment Strategy

Our core thesis is predicated on our firm belief that ‘everything is about to change as digital assets become the fourth superclass of assets. As the digital currency market formalises and becomes regulated, it continues to represent a new frontier for accredited investors to seek superior risk-adjusted returns that are uncorrelated with traditional equity and debt markets. These markets are

inefficient and represent substantial sources of alpha for skilled investment managers.

Our experienced team brings an institutional-grade investment approach combining both quantitative and qualitative investment analysis with prudent portfolio construction to provide access to this unchartered space. We aim to consistently deliver positive performance with reduced volatility via uncorrelated strategies that achieve upside as the sector grows and which preserve capital in down-markets via diversification across differing systematic trading strategies.