February 2024 Market Commentary

February 2024 Market Commentary

Market Update – Mark Witten CIO

Cryptocurrency and Digital Assets (“Crypto Assets”) markets started the year decisively after the strong rally in Q3 2023 as investors continued to allocate enthusiastically to the space. Bitcoin (BTC) gained +44% in February and the market as represented by the CCI30 Index was up +35%. The Portal Digital Fund finished February up +20% with the Radiance Multi-Strategy Fund up 29%. As of March 10th, the Radiance strategy was up a further 34.7%.

Listen to the February market commentary by Mark Witten here.

We are pleased to report that the Portal Digital Fund has been awarded the Number 1 Multi-Manager Fund by BarclayHedge ranked on performance for 2023, finishing the year up 49.3% net of fees!

Macro Outlook and Portfolio Positioning

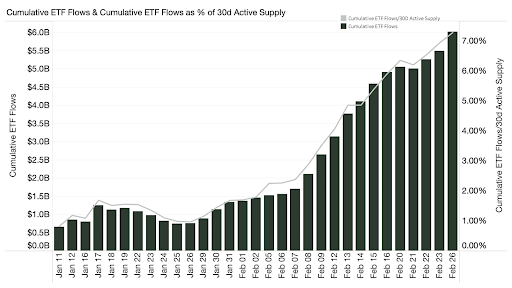

We reiterate our view from mid-2023 that this is the beginning of a multi-year secular bull market. This is not a cyclical bull market driven by changing interest rate expectations and sector rotation, but rather a secular bull market. This is evidenced by the phenomenal growth in ETF adoption as per the chart below.

The drivers of this secular bull market are the growing momentum in mass adoption by investors globally as not only a viable, alternative mainstream asset but one in which institutional participation becomes crucial for both their evolution and indeed survival.

Demand Shock

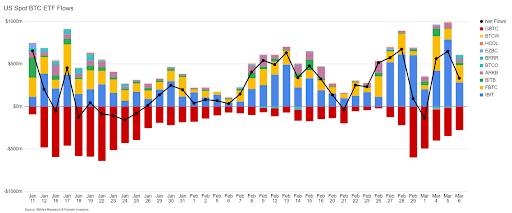

We don’t believe investors have understood the full implications of the vast amount of investable funds that have been unlocked by ETFs, but also how the continuing debasement of currency and rising geopolitical risks would continue to underpin new demand. This is not a movement along the demand curve, it’s a sharp shift upwards to a new sustained level of demand. We continue to see massive inflows into Bitcoin ETFs, with around $600 million worth of Bitcoin being purchased daily by institutions like Blackrock, ARK and Fidelity as per the chart below.

Supply Squeeze

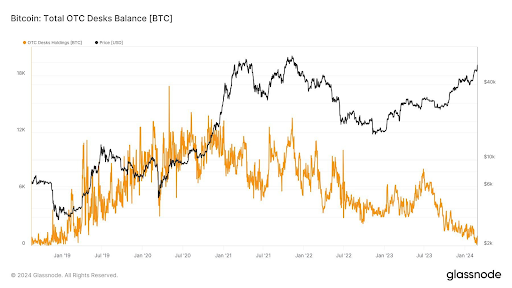

This contrasts with the $60 million worth of Bitcoin mined daily before the halving and the $30 million afterwards, making the $30 million post-halving difference increasingly significant. As per the chart below, we can see that there are dwindling amounts of BTC (and soon ETH) on offer via the OTC market. After the halving in April and the expected approval of the ETH ETF in May, we will see this short supply squeeze exacerbated. This will further fuel the rotation into the medium and small-cap tokens as new thematic ETFs and increased institutional investment drive the next real wave of the bull market.

Portfolio Positioning – The Rotation from BTC to High-Quality ALTS

Both funds remain strategically positioned to maximize returns ahead of the upcoming halving event and rotation from BTC to other high-quality alts. The risk remains firmly to the upside. For Radiance this includes diversified investments across Layer 1’s and Layer 2’s and other top projects across the decentralized finance ecosystem. We are also finalising our research on several new nascent and emerging tokens, and incorporating our proprietary Quantitative Factor Model – Pathfinder.

We remain extremely bullish on the current market setup overall and strongly believe that we are facing the start of this industry’s third multi-year bull run. The fundamental difference in this cycle is that the institutions have arrived, all at once!

Crypto-Specific Market Commentary Greg Galton Senior Analyst

Most of 2023 was about accumulation and protection from the downside, with BTC dominance rising from 41% at the start of the year to 52% by the end of the year, meaning BTC outperformed most tokens in 2023. The Radiance Fund’s positioning in the largest Layer 1’s, BTC, ETH and SOL, through 2023 positioned the portfolio well to outperform. Indeed, SOL was one of the few tokens to outperform BTC in 2023, driven by an improvement to its tech stack, the Firedancer upgrade, and a strong 520% lift in total value locked, due to growth in liquid staking and airdrop farming.

See market commentary with Greg Galton here

As we moved into 2024, we recognised the impact of fund flows into the BTC ETFs and the resultant impact on the rest of the ecosystem. This led us to take a more bullish approach for 2024 and beyond, driven by a view of the need to scale blockchains, hence positioning the fund into layer 2 blockchains, as well as taking positions in some of the well-placed, emerging Layer 1’s.

- One such emerging Layer 1 is Injective Protocol (INJ) – The Blockchain for Finance. Injective is an open, interoperable Layer 1 blockchain, specifically for building DeFi applications and was created to be decentralized, permissionless, and with zero gas fees. It is backed by the Cosmos blockchain infrastructure and bridged to Ethereum. Injective’s unique selling proposition is its ability to deliver an array of high-quality DeFi products to customers, who are then able to white-label these products as their own. See Beyond Bitcoin Interview here

- Bitcoin ETFs Continue to Drive Demand. Bitcoin has pushed past US$60,000 for the first time in more than two years and has jumped over 40% already in 2024. The surge in demand for the cryptocurrency resulting from the new ETFs, running at over US$500 million per day for the past two days, is vastly outstripping the supply of new tokens being created in the mining process at around 900 BTC per day, or just under US$56 million.

- SOL Breaks a Year-Long Run. The Solana blockchain went down for almost 5 hours early in the month, breaking a run of almost 12 months without any major shutdowns. The Solana token took the outage in its stride, recovering its pre-outage price of US$95 even before the chain was restarted. While disappointing that an outage occurred at all, indications are that it may have been human error and not an issue with the chain.

- Uniswap Propose Fee Distribution. According to data from Token Terminal, the annualized LP fees for Uniswap are approximately US$626 million. Assuming the proposal is passed and 1/10 to 1/4 of the LP fees are distributed as protocol fees to UNI holders, then UNI holders could receive approximately US$62.62 million to US$156.5 million in annual dividends. That’s equivalent to a yield of 0.9% to 2.4% based on the current UNI market capitalisation of US$6.6 billion.

- Ethereum Staking, Liquid Staking, now Restaking. DeFi users have flocked to restaking protocol EigenLayer and liquid restaking protocols recently given the possibility of a free airdrop, with Eigen Layer total value locked growing rapidly to more than US$9 billion. EigenLayer aims to tackle Ethereum’s scalability and security issues through a restaking system. The method allows ETH stakes to use their staked assets across various protocols, bolstering the network’s safety and effectiveness.

- Time to Take Your Bear Mask Off. MetaMask, the most popular web3 wallet, said its monthly active users have increased from 19 million in September last year to more than 30 million currently, almost returning to the peak of the last bull market. MetaMask hit a high of 31.7 million monthly active users in January 2022.

- Ordinals are (Not) Dead. The Magic Eden Bitcoin market reached US$100 million in trading volume in February and captured US$2 million in fees, both record highs. 45k buyers have made Bitcoin NFT purchases through Magic Eden this month. Bitcoin NFTs have generally experienced a rise recently, with NodeMonkes rising 105% in the past 7 days and Bitcoin Puppets rising 130%.

- Who’s a Pretty Boy Then? Inscription #2, an animated gif of a cartoon budgie, and one of the earliest inscriptions on BTC, sold for 24 BTC or over US$1.4 million. The buyer said on X (formerly Twitter) that they bought after seeing the BTC ETF inflows and will probably sell it for 100+ BTC within two years.

- Bridging to a Token. Cross-chain bridge protocol Wormhole announced the token economics of the native token W, with a maximum supply of 10 billion and an initial circulating supply of 1.8 billion. Tokens are available in ERC-20 and SPL. 82% of the tokens will be locked initially and then unlocked over four years.

- Chiliz Heating Up. Sports blockchain network Chiliz has announced a multi-year strategic partnership with the K-League, South Korea’s top professional football league, to integrate “K-League Fantasy” into Chiliz. The K-League will also become the first sports organization to be a node validator on the Chiliz chain.

- Bitcoin to be Used to Secure Your Favourite PoS Chain. Binance Labs has invested in Babylon, a Bitcoin staking protocol that pioneers the concept of native Bitcoin staking allowing users to stake bitcoins for PoS blockchains and earn yields without any third-party custody, bridge solutions or wrapping services.

Additional Commentary: Altcoins Opportunities in 2024

We also believe that in 2024 there will be several alternative coins, or “altcoins”, that present unique opportunities. Altcoins like XRP, Solana, Polygon2.0 and The Graph offer both diversification benefits and innovation.

- Polygon is rolling out its Polygon 2.0 upgrade, aimed at further enhancing the platform’s scalability and utility. This improvement is expected to make Polygon an even more attractive choice for developers and users within the crypto ecosystem. It is expected to replace its existing MATIC token with a POL token.

- Solana introduced as a potential challenger to Ethereum, has been the best-performing Altcoin in 2023 at 520%+. Its innovative hybrid consensus model, combining proof-of-history and delegated proof-of-stake, enables rapid transaction processing at significantly lower costs than Ethereum. Solana’s growth trajectory underscores its potential to play a significant role in the crypto market.

- Ripple’s XRP experienced a notable surge following its legal victory against the SEC. Ripple’s payment settlement system and currency exchange network make XRP a promising investment. Designed as a faster and cost-effective alternative to traditional financial networks, XRP’s potential lies in its utility.

- The Graph (GRT) is an open-source software that utilizes the Ethereum blockchain. GRT was created with the purpose of gathering, processing, and storing various types of data for blockchain-based platforms. The Graph intends to increase the accessibility of blockchain data and is a real beneficiary of growth in the DeFi and NFT infrastructure.

The year ahead promises to be an exciting one for the entire crypto ecosystem, characterized by fresh developments, increased adoption, and market dynamics that the diversification, adoption and expansion of the crypto market. See market commentary with Greg Galton here

Conclusion: The Investment Case for Crypto

Declining supply, rising demand, political support, regulatory approval and the inevitable Fed pivot are all coinciding in 2024. Not to mention tail risks like multiple global wars and runaway national debt driving demand for the stability BTC represents (billionaire Larry Fink called Bitcoin a “flight to safety”).

We expect this will not happen in a straight line, but the trend is clear: The stars are aligned for Crypto Assets to have a bull run in 2024 which will further drive growth in the Altcoins as a reversion to mean plays out. It was our view that Q4 2023 would see the market turn. It has. It is now our view that this is the beginning of a secular bull market that is likely to play out well into 2025.

Feel free to contact me should you have any enquiries.

Contact: E: [email protected] W: www.portal.am