Portal’s May Market Commentary

Portal’s May Market Commentary

INTRODUCTION

This has been the strangest three months the world has witnessed since 9-11. The COVID-19 pandemic has triggered an extraordinary policy response globally due to the depth and magnitude of the economic drop-off due to the global lockdown. This has spurred quantitative easing (QE) and the direct monetisation of massive fiscal spending to levels previously unimagined.

UNLIMITED QUANTITATIVE EASING

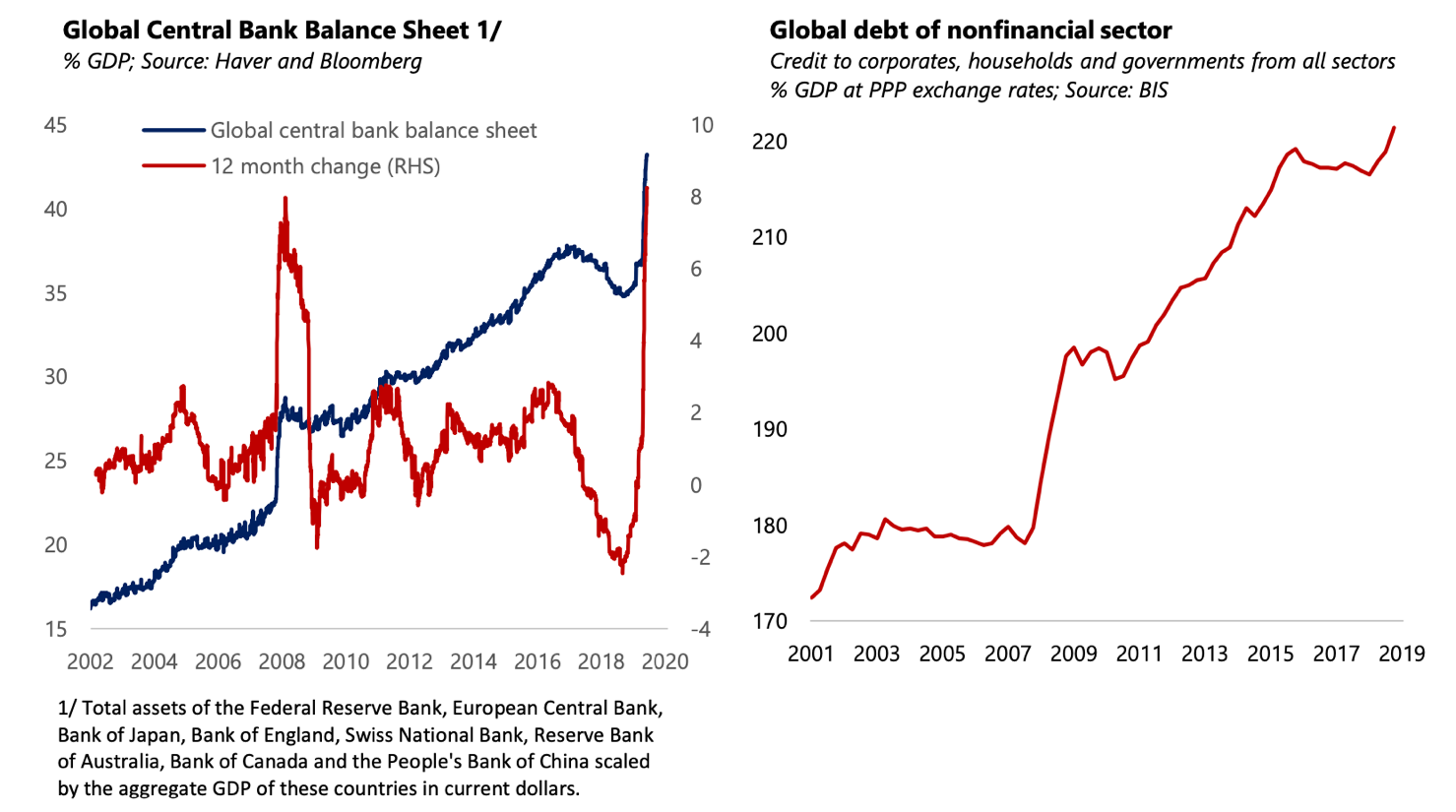

Since February, a global total of $4 trillion (6.6% of global GDP) has been magically created through QE an unprecedented expansion of every form of money, unlike anything the developed world has ever seen as peer the charts below.

As discussed in our last market update, the result has been asset price reflation in the form of a “V” shaped recovery in global markets. Due to rapidly growing unemployment and destruction of household savings, a significant consumer demand shortfall will prevent inflation from rising in the short-term. The question is whether that will be the case in the long term with central banks globally ensuring zero-interest rates and excess liquidity to repair the worst employment crisis since the Great Depression. We continue to believe that the markets have dislocated from their fundamentals in the short-term.

As discussed in our last market update, the result has been asset price reflation in the form of a “V” shaped recovery in global markets. Due to rapidly growing unemployment and destruction of household savings, a significant consumer demand shortfall will prevent inflation from rising in the short-term. The question is whether that will be the case in the long term with central banks globally ensuring zero-interest rates and excess liquidity to repair the worst employment crisis since the Great Depression. We continue to believe that the markets have dislocated from their fundamentals in the short-term.

To date, traditional hedges like gold have done well, and we expect investors to continue to seek refuge in this safe asset. However, in a world that craves new safe assets with the potential for higher returns, there is a growing role for digital currencies, which were born in the GFC in 2008 and have come of age in the latest crisis.

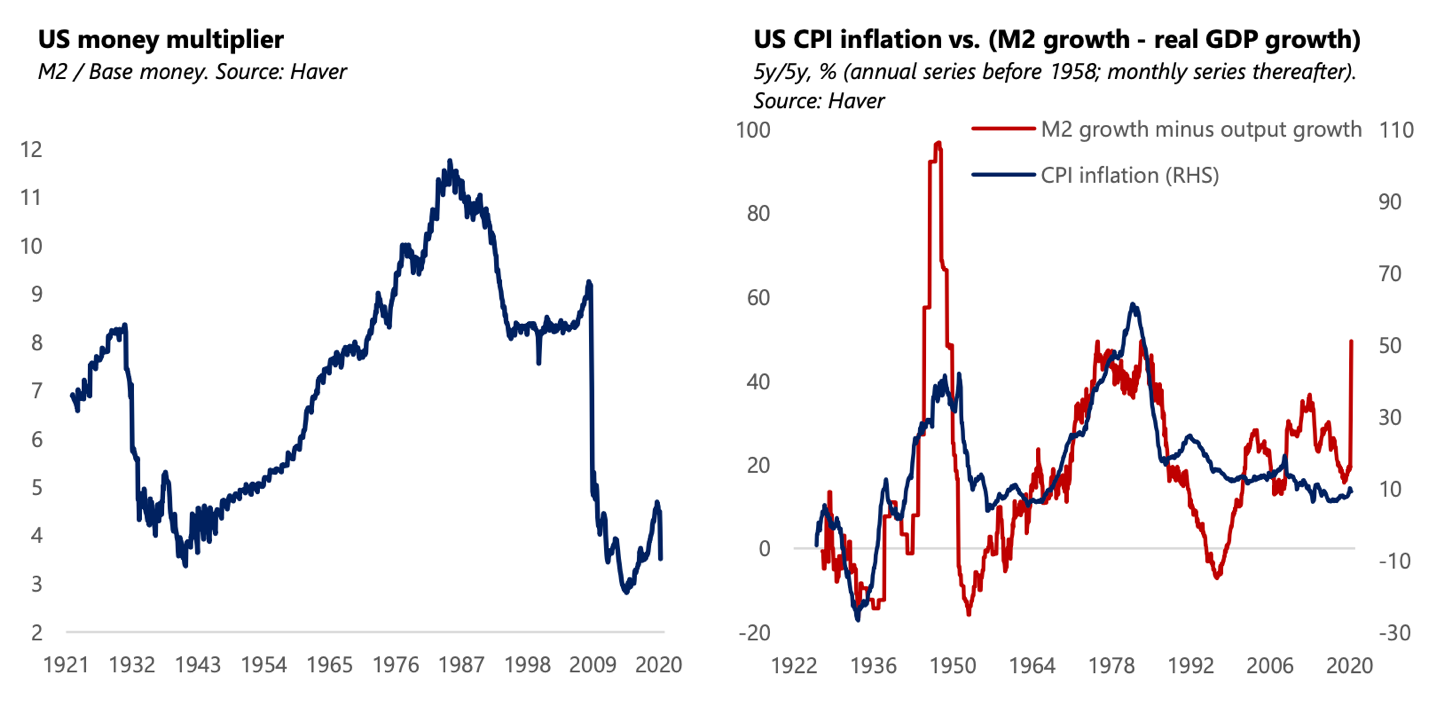

Milton Friedman famously stated that “inflation is always and everywhere a monetary phenomenon that arises from a more rapid expansion in the quantity of money than in total output.” And while the relationship between inflation and monetary supply growth above real output growth has not been stable over short horizons, it seems to hold over longer horizons. There are only a few times in history when money supply growth exceeded real output growth over five years by the same or a faster pace than is currently the case: the inflationary periods of the 1970s–80s and the late 1940s. But remember, it is reasonable to expect inflation to first fall in the coming months, given the massive contraction in demand relative to supply.

The four issues for investors to consider when allocating capital are:

- Whether a large monetary overhang in the recovery phase will eventually stoke consumer price inflation through the debasement of fiat currency.

- Are corporate earnings going to justify the current lofty equity valuations and market multiples given the collapse in consumer demand?

- Can interest rates go any lower or stay this flat indefinitely, and what does this mean for the yield curve and investing in bonds?

- Is real estate immune from this crisis given the continued growth in online away from bricks and mortar and rising vacancies?

ASSET ALLOCATION DURING THE NEW NORMAL

So, with this type of monetary growth as a backdrop, how do we navigate these extraordinary times and policy actions?

In the first instance, we would need to ensure the investment is a valid store of value. This is anything that holds its purchasing power in the future. Traditionally, financial assets comprise the largest store of wealth in the world as they generally have the added advantage of providing a yield, which is a hedge against inflation.

Gold has survived the test of time, although it has no particular transactional or industrial use. Fiat currency/cash is backed by the full faith and credit of the people in their government. And the newest entrant is Bitcoin, which seems to have emerged from the crypto war of 2017 as the clear winner with a market capitalisation 10x that of its closest competitor.

So how do these stores of value stack up against each other? In Paul Tudor Jones’ latest Macro Perspective, they graded stores of value on four characteristics:[1]

- Purchasing Power – How does this asset retain its value over time?

- Trustworthiness – How is it perceived through time and universally as a store of value?

- Liquidity – How quickly can the asset be monetised into a transactional currency?

- Portability – Can you geographically move this asset if you had to for an unforeseen reason?

They excluded real estate, art and precious stones as they will fall to the bottom of the ranking automatically because of generally inferior liquidity and portability characteristics. So they focused on financial assets, fiat currency, gold, and now Bitcoin. To offer perspective, Table 2 shows the value of these assets at the present time:

- When it came to purchasing power, carry was the main argument as the only way to defeat inflation was with some type of yield—i.e., financial assets. It must be noted that virtually all financial assets will be shunned if the yield cannot keep up with inflation.

- In the category of trustworthiness, Bitcoin got the lowest score because it is also the youngest entrant at 11 years of age. Although it has 60 million users in almost 200 countries, it is seen as less trustworthy than gold, which has stood the test of time for thousands of years.

- Liquidity is one of those things that never matter until it does, every ten years it seems. It is reasonable to assume, given the number of bankruptcies we are about to witness and the number of people who will be jobless and near poverty, that both companies and individuals will have a much higher preference for liquidity in coming years. Cash scored the highest while financial assets are a mixed bag because some, like VC, private equity and bespoke credit instruments, are illiquid. Interestingly, Bitcoin is the only store of value that actually trades 24/7 in the entire world.

- Finally, there is portability. Like liquidity, it is not an issue until it is. Imagine a geographic upheaval whether it be caused by war, an epidemic, or change in government that becomes hostile to holders of wealth. A great store of value can be seamlessly moved from one jurisdiction to another with little or no transaction costs. Cash is obviously good for that; gold is ok but clunky; but, of course, nothing beats Bitcoin, which can be stored on a smartphone among other options.

THE CASE FOR DIGITAL CURRENCIES

The case for owning Bitcoin is the quintessence of the scarcity premium. It is the only sizeable tradeable asset in the world that has a known fixed maximum supply. By its design, the total quantity of Bitcoins (including those not yet mined) cannot exceed 21 million. Approximately 18.5 million Bitcoins have already been mined, leaving about 10% remaining.

On May 12th Bitcoin’s mining reward – the pace at which the supply of Bitcoin is increased – will for the third time be “halved” (falling from 12.5 to 6.25 Bitcoins per block of transactions added to the blockchain).

Future halvings will likewise occur approximately every four years consistent with Bitcoin’s design, thus continuing to slow the rate of supply increase and causing some to estimate that the last available Bitcoin will not be mined for another 100+ years. This brilliant feature of Bitcoin was designed by the anonymous creator of Bitcoin to protect its integrity by making it increasingly near and dear, a concept alien to the current thinking of central banks and governments.

What surprised them was not that Bitcoin came in last, but that it scored as high as it did. Bitcoin had an overall score of nearly 60% of that of financial assets but has a market cap that is 1/1200th of that. It scores 66% of gold as a store of value but has a market cap that is 1/60th of gold’s outstanding value. The only way to balance this equation is via a rapid appreciation in Bitcoin price.

Owning Bitcoin is a great way to defend oneself against reflation, given the concerns expressed above. As Satoshi Nakamoto, the anonymous creator of Bitcoin stated in an online forum around the time he launched Bitcoin, “the root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full breaches of that trust”.

We do not advocate Bitcoin ownership in isolation but do believe digital currencies have a place in investment portfolios. Investment strategies should also be adaptable and evolving, as is the real world. Digital Currencies as an investable asset fall into the category of a store of value, and it has the bonus of being semi- transactional in nature. The average Bitcoin transaction takes around 60 minutes to complete, which makes it “near money.” It does compete with other stores of value such as financial assets, gold and fiat currency, and less liquid ones such as art, precious stones and land.

CONCLUSION

The most compelling argument for having exposure to digital currency is the coming digitisation of currency everywhere, accelerated by COVID-19. Bull markets are built on an ever-expanding universe of buyers. Central to the price of digital currencies is how many more (or less) owners of them will there be beyond the 60 million who currently own it? The probable introduction of Facebook’s Libra (whose value will be pegged to the US dollar and will not be a store of value in that sense) as well as China’s DCEP, also tied to the Yuan, will make virtual digital wallets a commonplace tool for the world. It will make the understanding, utility, and ease of ownership of Bitcoin a much more commonplace option than it is today.