June 2021 Newsletter

June 2021 Newsletter

June 2021 Performance

June – 6.8%

Top 30 Index – 19.5%

BTC – 6.1%

YTD +40.3%

To view this email in PDF, click here.

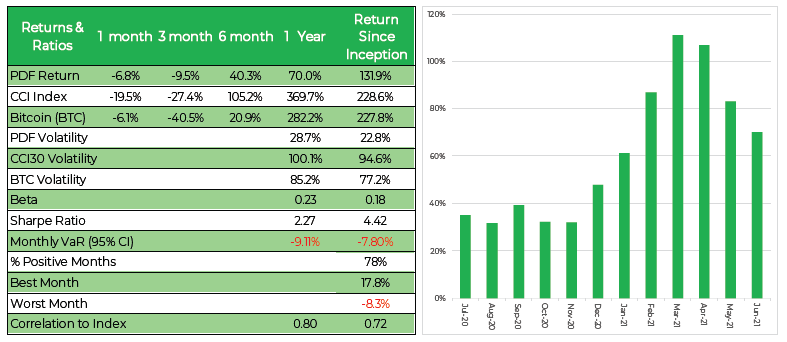

Portal finished down 6.8% for June up 40.3% YTD. The CCI30 Index and DeFi sector was down 19.5% in June, whilst Bitcoin finished down 6.1%. The price of Bitcoin was range-bound in June with relatively little volatility trading between $30,000 and $40,000 and seems to have stabilised in this range as it consolidates. Portal remains bullish on the fundamentals of the digital currency markets but has maintained a relative overweight position towards lower risk / market neutral strategies until we see a clear signal that liquidity has returned to the market and the volatility has stabilised.

Description

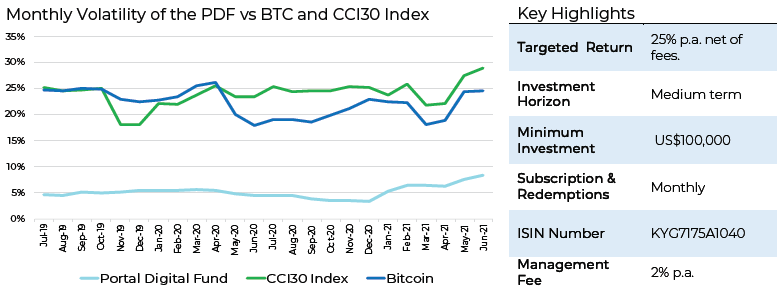

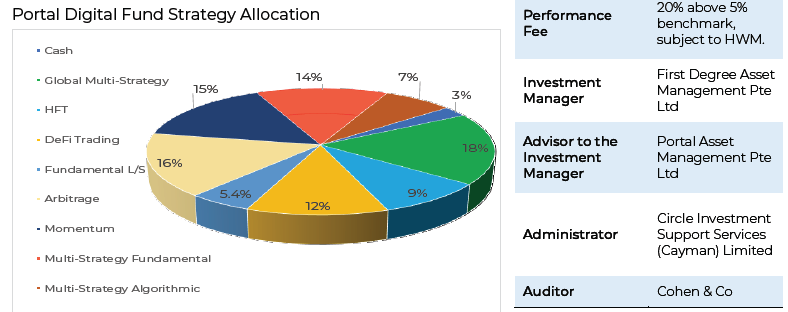

The Portal Digital Fund (the “Fund”) is an actively managed Global Fund of Funds focused on the digital currency investment space. The Fund seeks to achieve medium to long-term growth through investing in a diversified portfolio of 5-10 specialist fund managers running uncorrelated digital currency trading strategies. The Fund is focused on absolute returns and expects to generate substantial outperformance with lower volatility versus the CCI 30 Index, the benchmark for digital currencies. The Fund’s targeted returns are 25% p.a. over a rolling 5-year period net of fees.

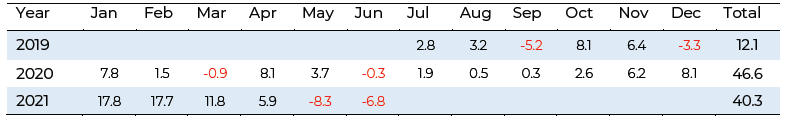

Strategy Monthly Returns

Investment Strategy Performance Statistics and Rolling 12 Months Returns

Fund Characteristics:

- Uncorrelated to global equity, currency and debt markets.

- Access to best-of-breed global fund managers specialising in digital currency-related strategies.

- A rigorous and repeatable due diligence process.

- Absolute return investment objective with managed volatility, seeking consistent incremental growth in capital.

- A robust risk-management approach, with an unrelenting focus on capital preservation.

- High liquidity and low exposure to systematic market risk.

- Targeted volatility of 15%-17% p.a. with a targeted return of 25% p.a. net of fees.

Investment Strategy

Our core thesis is predicated on our firm belief that ‘everything is about to change’ as digital assets become the fourth superclass of assets. As the digital currency market formalises and becomes regulated, it continues to represent a new frontier for accredited investors to seek superior risk-adjusted returns that are uncorrelated with traditional equity and debt markets. These markets are inefficient and represent substantial sources of alpha for skilled investment managers.

Our experienced team brings an institutional-grade investment approach combining both quantitative and qualitative investment analysis with prudent portfolio construction to provide access to this unchartered space. We aim to consistently deliver positive performance with reduced volatility via uncorrelated strategies that achieve upside as the sector grows and which preserve capital in down-markets via diversification across differing systematic trading strategies.

Based on our comprehensive and rigorous due diligence process, we provide investors with access to the best global fund managers specialising in digital currency trading strategies via investment in a diversified Fund providing solid returns irrespective of the direction of the digital currency markets.