February 2022 Newsletter and Market Commentary

February 2022 Newsletter and Market Commentary

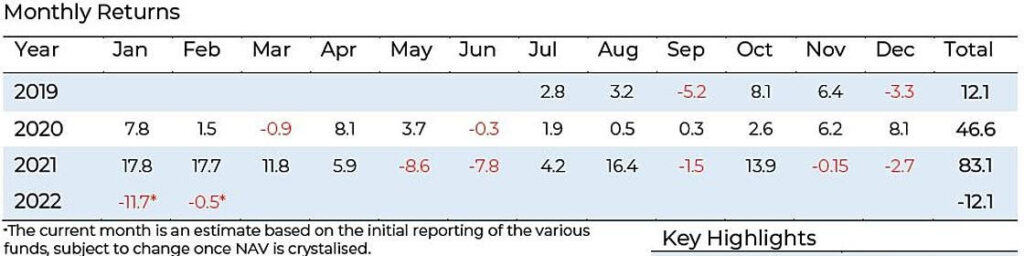

| Portal Digital Fund | |

| February: -0.5%* | |

| 2021: 83.1% | |

| YTD: -12.1% | |

| Since Inception: 165.8% |

| Horizon Index Fund | |

| February: -6.9% | |

| YTD: -35.5% | |

| Since Inception: -30.6% | |

Market Commentary from Mark Witten, CIO

Cryptocurrencies and digital assets (“crypto assets”) have now been embraced as a conventional asset class by most investment professionals and are now discussed daily in all major financial media outlets. Investors are embracing

crypto assets as they begin to understand the potential they have to provide secure, unbiased, and decentralised access to a new world of financial opportunity and innovation for billions. This is particularly true with the disintermediation that Web 3.0 represents and current concerns around government overreach in the traditional banking sector.

February 2022 Monthly Performance

Performance Review

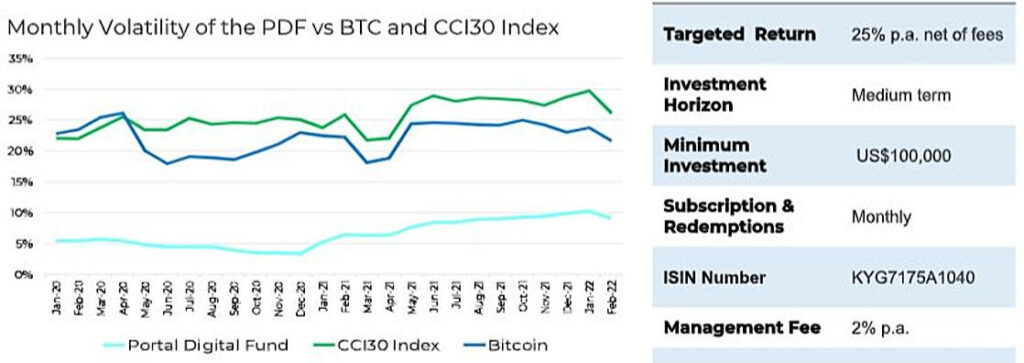

The Portal Digital Fund was down -0.5% net of fees in February vs BTC (Bitcoin) up 12.2% and the CCI30 Index was up 10.3%. The big rally of approximately 15% occurred on the last day of February EST and we expect some of these gains to be reflected in the performance of the underlying funds in March

Fund Characteristics:

- Uncorrelated to global equity, currency, and debt markets.

- Access to best-in-class global fund managers specialising in digital currency-related strategies.

- Absolute return investment objective with managed volatility, seeking consistent incremental growth in capital via a rigorous and repeatable due diligence process.

- A robust risk-management approach, with an unrelenting focus on capital preservation.

- High liquidity and low exposure to systematic market risk.

- Targeted volatility of 15%-17% p.a. with a targeted return of 25% – 30% p.a. net of fees.

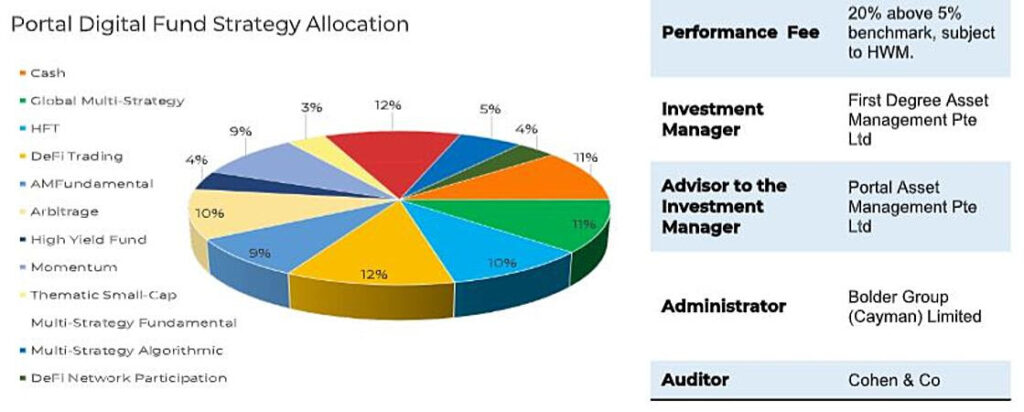

Investment Strategy

Our core thesis is predicated on our firm belief that ‘everything is about to change as digital assets become the fourth superclass of assets. As the digital currency market formalises and becomes regulated, it continues to represent a new frontier for accredited investors to seek superior risk-adjusted returns that are uncorrelated with traditional equity and debt markets. These markets are

inefficient and represent substantial sources of alpha for skilled investment managers.

Our experienced team brings an institutional-grade investment approach combining both quantitative and qualitative investment analysis with prudent portfolio construction to provide access to this unchartered space. We aim to consistently deliver positive performance with reduced volatility via uncorrelated strategies that achieve upside as the sector grows and which preserve capital in down-markets via diversification across differing systematic trading strategies.

February 2022 Monthly Performance

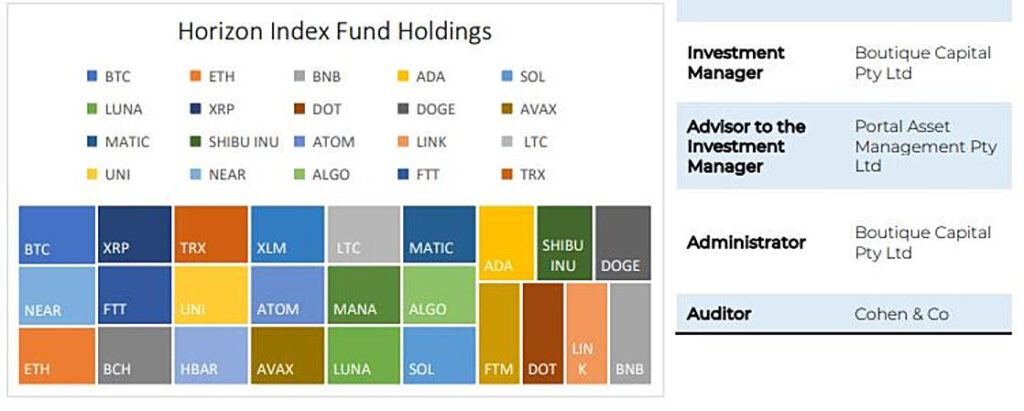

Description

The Fund is a passively managed Equally Weighted Index Fund that is focused on replicating the performance of the top 25 listed digital assets and cryptocurrencies by market capitalisation and is rebalanced monthly. The Fund seeks to replicate the performance of the overall digital asset and cryptocurrency market, and will have volatility in line with the markets.

Performance Review

The Horizon weighted index fund was down -6.9%. The Horizon Index Fund underperformed the overall market due to the following reasons.

The big rally happened after month’s close for the Horizon Index Fund which is 11:55 AEST is the strike time for that fund on Binance Australia. The Fund had BTC marked as slightly down for the month. We expect this to unwind as the valuations converge. It was a very unusual close with a 15% rally literally in the last hours of USA time zone month end.

Secondly as the fund is equal weighted, the other tokens have an equal influence as does BTC and ETH. Some of the tokens finished down more than 15% (eg ADA and LINK) as the recovery rally was driven first by the most liquid being BTC and ETH, which dominate the CCI30 Index. We expect the second order liquidity effect to flow into the other tokens and they should outperform in a market rally.

Lastly, the exchange rate moved 7%:

- Exchange rate on 31 January 2022 is $ 0.69944 USD/AUD

- Exchange rate on 28 February 2022 is Rate 0.71819 USD/AUD

- The AUD/USD exchange rate increased around 7% – this potential being the main reason for the 6.9% loss.

This will also wash out over time but you could see some further translation losses as the flight to safety continues given global geopolitical risks:

Fund Characteristics:

- An unhedged, passively managed index-tracking portfolio offering broad exposure to the top cryptocurrencies, DeFi and Smart Contract tokens.

- Diversified exposure to the broader digital asset landscape and most cutting edge blockchain projects maintained via monthly rebalancing.

- Low costs (3% management fee) and volatility in line with the market.

- Although the portfolio is passively managed, the strategy benefits form the research conducted on the actively managed Portal Global Opportunities Fund to avoid tokens deemed high risk.

The Rationale for Index Investing

- Index funds are a way of gaining diversified exposure to the overall cryptocurrency and digital asset markets.

- Investing in a broad representation of tokens in a market index can provide efficient diversification and

reduce risk. - Buying and holding a broad market index over the long – term reduces volatility and investment costs and can lead to better returns in the long run.